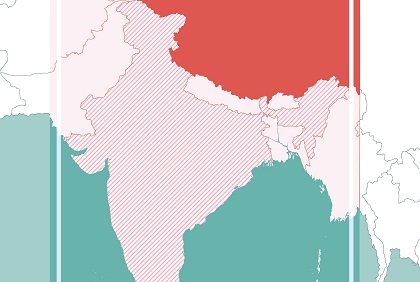

India in the virtual Belt and Road

Over the last five years, China has quietly created a significant place for itself in India – in the technology domain. While India has refused to sign on to China's Belt and Road Initiative (BRI), this map shows India's positioning in the virtual BRI to be strategically invaluable for China. Nearly $4 billion in venture investments in start-ups, the online ecosystem and apps have been made by Chinese entities. This is just the beginning; there is much more to come.