India-Russia relations march ahead

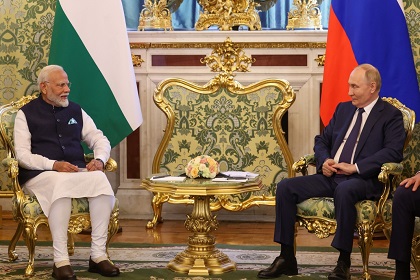

The 22nd India-Russia summit, held in Moscow on July 9 during Prime Minister Modi’s official visit, focused on expanding bilateral economic, energy, cultural and defense cooperation. It indicates the two nations’ commitment to adding substance and new momentum to their relationship. The long-delayed summit, which coincided with the NATO summit in Washington, should be viewed through the wider lens of a multipolar world.