From February 16-21, at the upcoming plenary session of the Financial Action Task Force (FATF), an inter-governmental body that serves as a global watchdog on money laundering and terrorist financing, 39 member countries will decide whether Pakistan will be retained on the grey list of countries, prone to such risks, or moved to the black list for non-compliance with FATF’s norms. Pakistan has been under the FATF’s review since 2008 for financing and supporting terrorist groups.

India has been very critical of Pakistan’s inability to curb money laundering and terrorist financing. After the Pulwama attack of 2019, it presented evidence to the FATF that revealed links between Pakistani agencies and the Jaish-e-Mohammad, which has taken responsibility for the attack, including funding support. So far, Pakistan has been able to stay on the edge, without making too much effort to correct its funding practices. This has drawn criticism of the FATF itself and its ability to compel member countries to adhere to its rules.

The February plenary session will once again test FATF’s credibility, especially on the compliance-based evaluations of countries on its ‘high risk and other monitored jurisdictions’ list.

For India, the FATF plenary is important. The session is strategically timed between the visit of External Affairs Minister S. Jaishankar to the European Union (EU) on 17 February 2020 and the visit of U.S. president Donald Trump to India on 24-25 February 2020. India will surely discuss Pakistan and its upcoming FATF review at these diplomatic interactions and hope to garner support to blacklist Pakistan.

Pakistan has been under pressure since June 2018, following an unsatisfactory evaluation of its compliance with FATF’s parameters. It was placed on the FATF’s list of “jurisdictions which have strategic Anti-Money Laundering/Combating the Financing of Terrorism (AML/CFT) deficiencies”. This is also known as the ‘grey list’, which puts the country under FATF’s intense scrutiny, with an action plan chalked out for it to overcome its anti-money laundering and anti-terrorist financing deficiencies. Pakistan made a commitment to work with the FATF and its Asia Pacific Group (APG) to comply with the action plan as per the interim deadlines in January and May 2019, and a final deadline in October.

In October 2019, the APG submitted a Mutual Evaluation report[1] on Pakistan to the FATF, along with its own assessment of the country’s efforts. The FATF conducts compliance assessments in two ways: Technical Compliance and Effectiveness. Technical Compliance is a review based purely on adherence to 40 already laid-down metrics. Effectiveness Compliance is based entirely on field reports and peer reviews of the 39 member countries of the FATF.

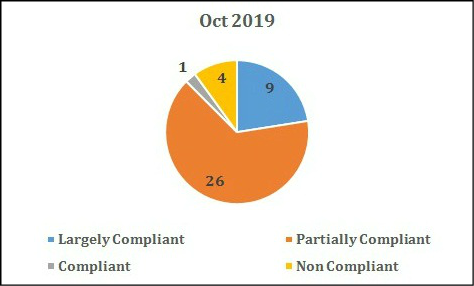

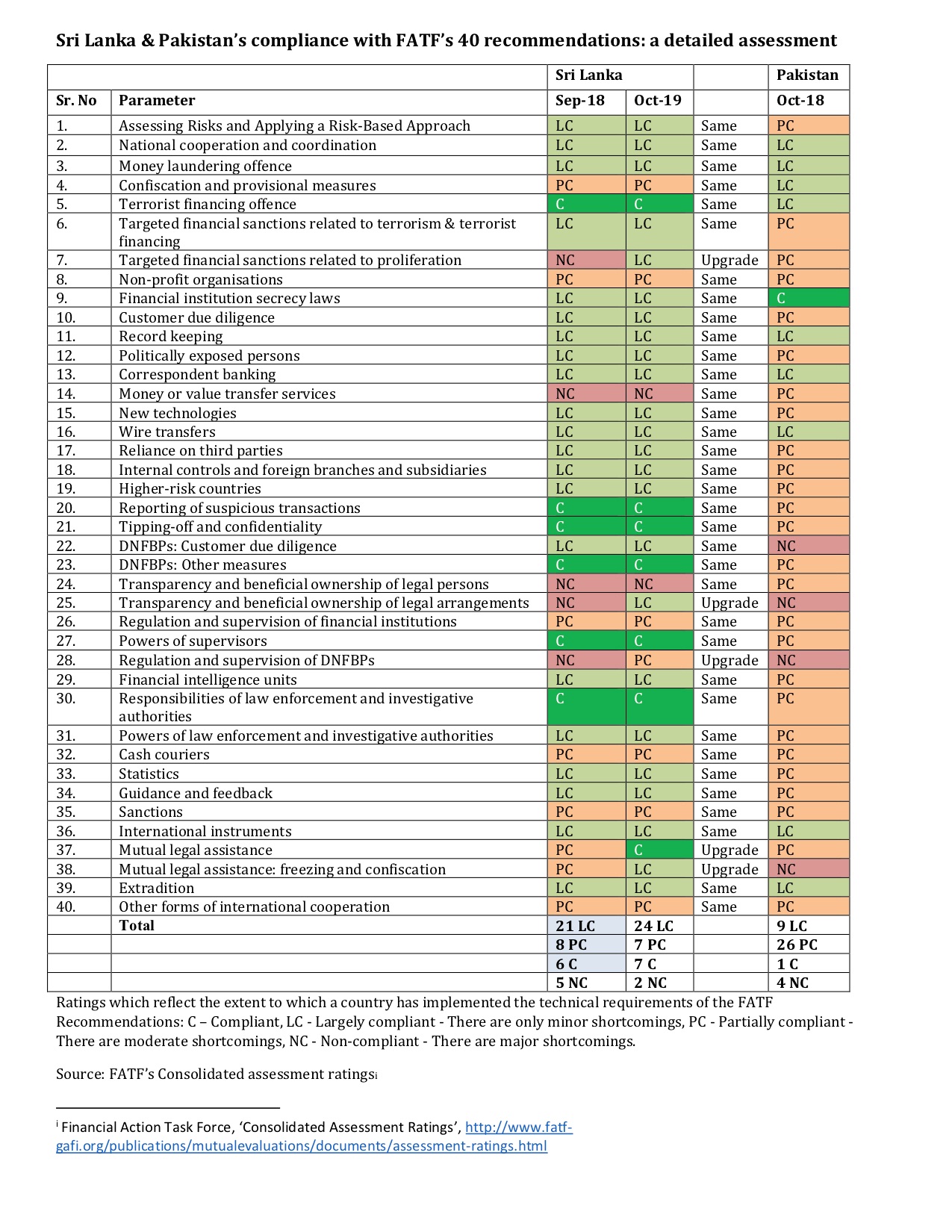

As on October 2019, in the FATF’s 40-point Technical Compliance metrics (See charts), Pakistan[2] was partially compliant on 26, largely compliant on nine, compliant on one and non-compliant on four. On the Effectiveness front, of the 11 parameters,[3] Pakistan was marked low on 10 and moderate on one.

The report recognised the actions taken by Pakistan, such as the introduction of a High-level National Committee on AML/CFT and the amendment of existing laws, like the Anti-Money Laundering Act of 2010 and Anti-Terrorism Act of 1997. It was found to be inadequate, even though Pakistan said it had developed monitoring and enforcement mechanisms, as well as mechanisms for inter-agency and stakeholder coordination, and released a National Strategy on AML/CFT.

The APG report pointed out that crucial institutions, like the State Bank of Pakistan and the Securities and Exchange Commission, among others, were not aware of this and had thus not undertaken any formal money laundering and terrorist financing sectoral risk assessments.

Based on this report, the FATF strongly urged Pakistan to complete its full action plan. The October 2019 deadline was then extended to February 2020: failing to meet it will require member countries to apply appropriate counter-measures in their business relations and transactions with Pakistan.

Now, only a week ahead of the FATF’s review meeting, Pakistan convicted Hafiz Saeed, the head of the Lashkar-e-Taiba (LeT) terrorist group, for his role in the financing of global terror. The timing of this verdict clearly shows Pakistan’s desperation for a clean review at the FATF.

Despite severe shortfalls, Pakistan escaped being placed on the black list due to support from three countries – China, Malaysia and Turkey – the minimum numbers required to stay off it. Now Pakistan has been given an extension till February 2020 to improve on compliance.

This is not the first time a country has been let off lightly from being blacklisted. Both Pakistan and Iran were placed under the FATF’s scrutiny under pressure from the U.S. Since then, the FATF has given extensions despite both countries failing to meet compliance requirements within the stipulated timeframes.

Pakistan’s compliance with FATF’s 40 recommendations in October 2019

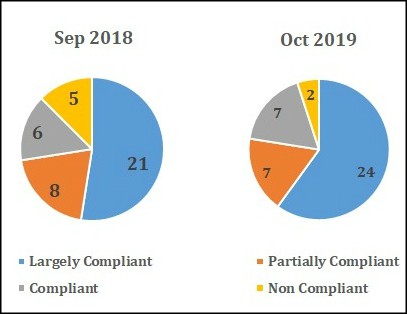

In September 2018, Sri Lanka was put on the FATF’s grey list, even though it had met more of the compliance criteria than Pakistan had in October 2019. Sri Lanka eventually got off the grey list with marginal improvements on technical parameters – but largely due to favourable effectiveness assessments by the APG and a unanimous decision by all member nations of the FATF, based on their own individual evaluations.[4]

Sri Lanka’s compliance with FATF’s 40 recommendations in Sept 2018 and Oct 2019

Countries try every method to stay off the black list, because being blacklisted means complete economic isolation. With Pakistan in dire financial straits, this is a drastic case.

Small wonder then that Pakistan prime minister Imran Khan has been appealing to several heads of state for support, including the U.S and several EU countries. He is desperate to garner the key 15 votes from member countries of the FATF so that Pakistan can stay off the black list, and, in fact, get off the grey list as well. In January 2020, at an FATF meeting in Beijing, Islamabad submitted evidence of the measures implemented by Pakistan, claiming that it had been able to make significant progress in addressing FATF’s AML/CFT recommendations. However, a recent statement by Australia’s outgoing high commissioner to India, Harinder Sidhu, indicated that Pakistan had not been able to comply with the FATF’s technical parameters, thus contradicting Pakistan’s claim at the meeting in Beijing.

When the FATF meets at the plenary session on February 16, it will have to make two important decisions: one on Pakistan, and the other on Iran. Iran was placed on the black list in 2012 and the country was economically isolated. All banking and financial relationships with Iran were cut off and it did not get access to any multilateral and bilateral funds. Following the Joint Comprehensive Plan Of Action (JCPOA), these measures were suspended for an initial period of 12 months and extended repeatedly since then due to support from the P5+1 countries (all members of the FATF). These countries are now trying to impose pressure on Iran by relaxing the FATF’s punitive measures to bring Iran back to the negotiating table on its nuclear issues.

At the review next week, the FATF will decide whether to continue the suspension of measures against Iran or impose fresh compliance parameters.

Prime Minister Narendra Modi, at the G20 summit in Argentina in 2018, made AML/CFT issues a priority through his nine-point agenda[5] to deal with fugitive economic offenders and terror financing. He urged the FATF to formulate a standard definition of fugitive economic offenders and develop standardised procedures for the ‘identification, extradition and judicial proceedings for dealing with fugitive economic offenders to provide guidance and assistance to G20 countries, subject to their domestic law’.

The race between India and Pakistan for 15 votes will run through the diplomatic channels of member countries in the coming week.

Purvaja Modak is Researcher, Geoeconomic Studies Programme, Gateway House.

This article was exclusively written for Gateway House: Indian Council on Global Relations. You can read more exclusive content here.

For interview requests with the author, or for permission to republish, please contact outreach@gatewayhouse.in.

© Copyright 2020 Gateway House: Indian Council on Global Relations. All rights reserved. Any unauthorized copying or reproduction is strictly prohibited.

References

[1] Asia Pacific Group on Money Laundering, ‘Anti-money laundering and counter-terrorist financing measures, Pakistan, Mutual Evaluation Report, Asia Pacific Group, October 2019, http://www.fatf-gafi.org/media/fatf/documents/reports/mer-fsrb/APG-Mutual-Evaluation-Report-Pakistan-October%202019.pdf

[2] Financial Action Task Force, ‘4th-Round Ratings’, Financial Action Task Force, 13 February 2020, https://www.fatf-gafi.org/media/fatf/documents/4th-Round-Ratings.pdf

[3] Financial Action Task Force, ‘4th-Round Ratings’, Financial Action Task Force, 13 February 2020, https://www.fatf-gafi.org/media/fatf/documents/4th-Round-Ratings.pdf

[4] Central Bank of Sri Lanka, ‘The Financial Action Task Force delisted Sri Lanka from the Grey List’, Central Bank of Sri Lanka, 21 October 2019,

https://www.cbsl.gov.lk/en/node/6701

[5] Narendra Modi, ‘Striking at the root of economic malpractices for a better future.’, Twitter, 1 December 2018,

https://twitter.com/narendramodi/status/1068661646862794752/photo/1