Oil not a worry in 2024

A well-supplied oil market, along with new investments in oil exploration and production means that pending a major disaster, India will not have to worry about oil prices in the coming year.

Courtesy: CNBC

Courtesy: CNBC

A well-supplied oil market, along with new investments in oil exploration and production means that pending a major disaster, India will not have to worry about oil prices in the coming year.

Courtesy: The Wire

Courtesy: The Wire

India and Sri Lanka recently signed six energy agreements, including plans for an oil pipeline from India to Sri Lanka, electricity grid connectivity, and cooperation in renewable energy. Sri Lanka can benefit from India's cost-effective oil sourcing and processing and pay for it in rupees, easing its balance of payments crisis. Its wider use of the Rupee fulfills a long term objective for Indian policymakers.

Courtesy: Nikkei Asia

Courtesy: Nikkei Asia

China-centric global supply chains are being disrupted by rising geopolitical tensions between the U.S. and China and multiple global shocks, forcing multinational companies to rethink are global sourcing strategies. India can leverage this moment to become a complementary manufacturing hub in Asia by reaping gains from technology transfers and creating value-adding jobs.

Courtesy: Kuwait Times

Courtesy: Kuwait Times

The 56th ASEAN Foreign Ministers Meeting in Jakarta reflected the grouping’s resilience amidst transformative geopolitical changes in the Indo-Pacific. Striving for unity and centrality, ASEAN tackled challenges posed by COVID-19, economic slowdown, climate change, and U.S.-China competition. However, internal differences on sensitive issues like Myanmar have tested its credibility.

Courtesy: The Times of India

Courtesy: The Times of India

On July 21, Sri Lankan President Ranil Wickremesinghe is set to visit for the first time since taking office. India has already provided $5 billion in economic assistance to Sri Lanka, and is now looking to expand its investment in the nation. Sri Lanka is also seeing interest from Indian private investment. The visit presents an opportunity for the two countries extend this relationship in new areas of cooperation, especially energy, infrastructure, and tourism.

Courtesy: Deutsche Welle (DW)

Courtesy: Deutsche Welle (DW)

On July 13, the German cabinet approved its Strategy on China after nearly two years of internal discussions. The new strategy simultaneously views China as a “partner, competitor, and systemic rival”, calling for de-risking German economic dependence on China, while also expanding cooperation with other countries in the Indo-Pacific region.

Courtesy: The Dahrendorf Forum

Courtesy: The Dahrendorf Forum

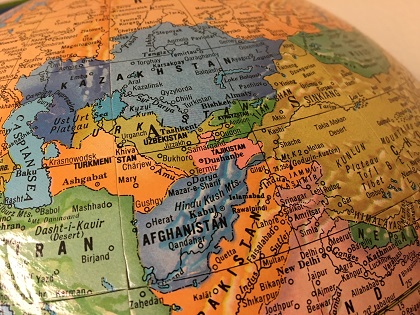

The Russia-Ukraine conflict has led to the resurgence of interest in Central Asian as an alternate trade corridor between Europe and Asia. Timely investment in connectivity projects like the Middle Corridor and the INSTC by regional stakeholders, as well as by the EU, China and India, must now build on this interest to create new regional, international, and cross-continental transport corridors.

Courtesy: Shutterstock

Courtesy: Shutterstock

India’s year-long G20 Presidency completed six months at a time of global economic slowdown and sharpening geopolitical contestation. While India has done well in leveraging the Presidency to articulate its vital goals, the success of the upcoming Delhi Summit will depend on achieving consensus, additionality, and implementability.

Courtesy: Dreamstime

Courtesy: Dreamstime

The focus on climate finance must take into account the high cost of debt, foreign exchange risk and weak public energy utilities in the developing economies. A creative and workable solution to all these issues is to establish a Global Climate Finance Agency, managed by a reputed multilateral agency with some of the capital support promised by the developed countries.

Courtesy: DW & Avalon_Studio/iStock

Courtesy: DW & Avalon_Studio/iStock

Many western governments and pressure groups are now turning to agriculture to curb carbon emissions. Given the legitimate concerns about security of food, nutrition and livelihoods, they may be looking in the wrong direction. If these groups are serious about reducing emissions, activities such as crypto-mining, with no positive net contribution, should be targeted first.