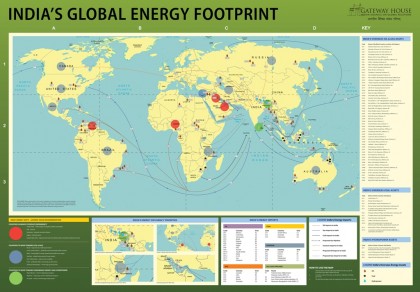

India & the influential SCO Energy Club

The main objective of the Shanghai Cooperation Organisation’s (SCO) Energy Club, when Russia formed it, was to market its member states’ substantial oil and natural gas reserves. This map shows some of the important natural gas pipelines, originating from Russia and its neighbouring countries that are not members of the SCO. What can India do to secure supplies from these abundant but currently inaccessible natural gas reserves?