India is energy-dependent; it is the world’s third largest petroleum importer, with 80% of its needs coming from abroad. Being agile in acquiring energy resources is critical for its survival and growth, and having a financially strong, government-owned oil major is one way to ensure that security.

This quest is becoming a reality. In February 2017, New Delhi proposed the creation of an energy giant, a conglomerate comprising its five major state-owned oil and gas companies which can be globally competitive and acquire assets abroad with alacrity and ease. The decision follows a decade of global energy asset acquisitions – and of late, having India itself be an attractive market for foreign oil majors.

In October 2016, for instance, Russia’s oil giant, Rosneft, acquired Essar Oil, the second largest oil refinery in India, for $13 billion – a first-of-its-kind deal in the country. It followed a year-long series of acquisitions by Indian oil companies in Russia and partnerships in oil exploration and production. These are big, productive assets with a strategic partner – a break from past investments in trouble spots like Venezuela, Syria and the Sudans.

India’s increasing confidence is evident in its successful lobbying to no longer pay the noxious ‘Asian Premium’, a surcharge that the Arab oil producers levied on their biggest consumers – India, China, Japan–for decades. This has been possible also because of the shift in the geopolitics of energy, caused by the abundance of shale oil in the U. S., and the increasing affordability of renewable energy – an area where India is a leader and early adopter.

India has benefitted from low energy prices since 2015 and remains in a comfortable position despite the recent jump in oil price to over $60 per barrel. This spike shows that the window of low energy prices will not be open forever and India must act quickly.

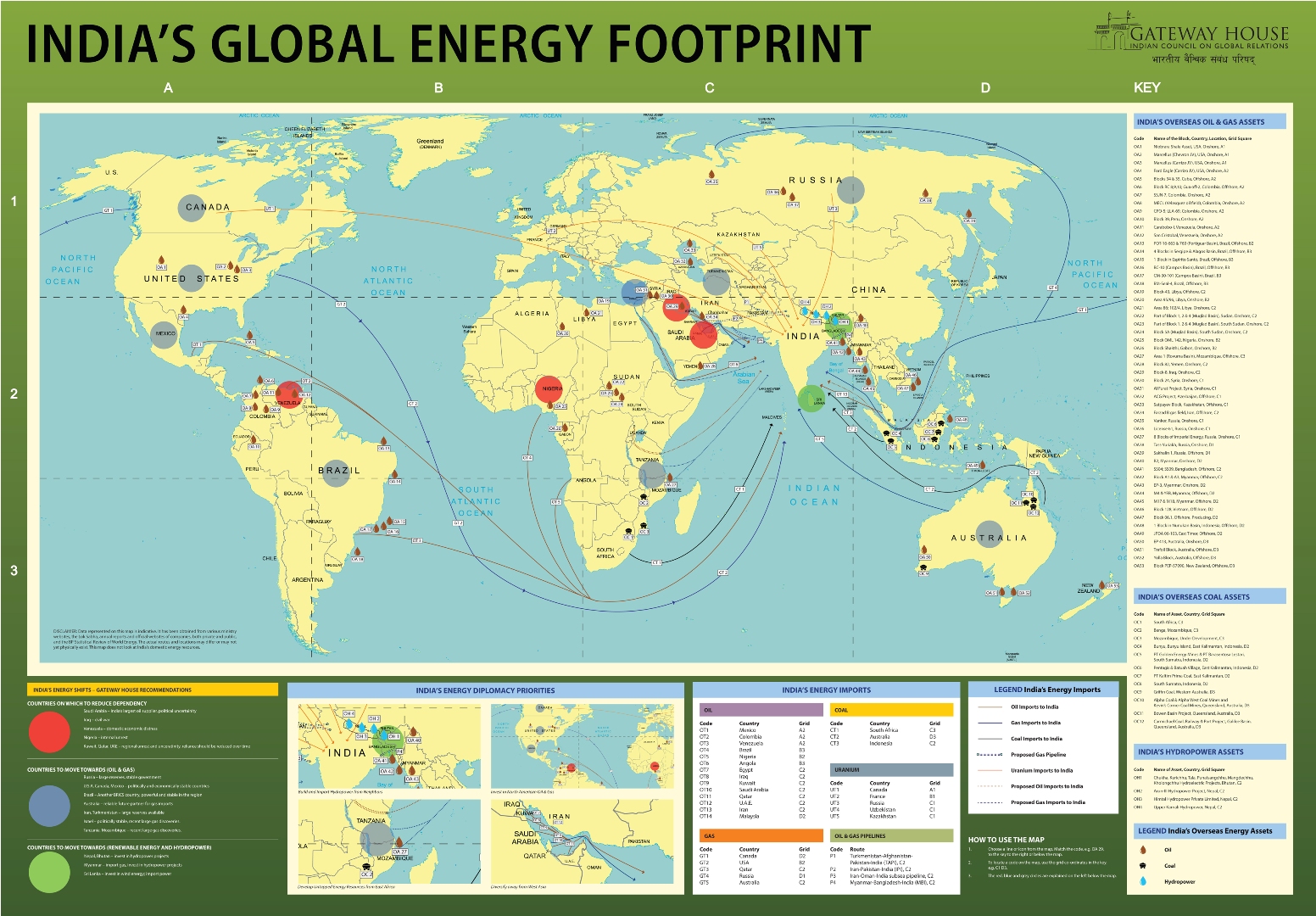

Gateway House has undertaken an extensive study to map India’s global energy footprint – including trade links and investments across the world. The result takes stock of India’s existing energy imports, foreign assets – oilfields, gas finds, hydropower – held by Indian entities around the world, and considers possibilities and opportunities for the future. That future lies with North America, Russia and Iran, and agreements with India’s neighbourhood on renewable energy.

Amit Bhandari is Fellow, Energy and Environment Studies at Gateway House.

Kunal Kulkarni is Senior Researcher at Gateway House.

The India’s Global Energy Footprint map is available only to Gateway House members. If you are interested in becoming a member, click here for more details.

This map was exclusively created by Gateway House: Indian Council on Global Relations. You can read more exclusive content here.

Other Gateway House Maps: Asia’s Strategic Corridors to India | Global Stability Map

For interview requests with the author, or for permission to republish, please contact outreach@gatewayhouse.in.

© Copyright 2017 Gateway House: Indian Council on Global Relations. All rights reserved. Any unauthorized copying or reproduction is strictly prohibited.