India must build the capacity to make its G20 presidency in the future a success

Our Director of Research, Akshay Mathur provides his views on India’s G20 presidency in 2022 in an op-ed for The Indian Express. Read the full article here.

Courtesy:

Courtesy:

Our Director of Research, Akshay Mathur provides his views on India’s G20 presidency in 2022 in an op-ed for The Indian Express. Read the full article here.

Courtesy: Imarticus

Courtesy: Imarticus

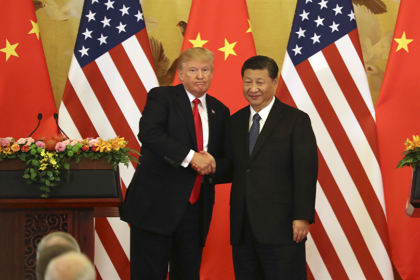

A G20 discussion around fintech is needed because of the emergence of global technology giants as data intermediaries which are expanding into the financial services industry. This is resulting in regulatory risks and challenges. The panel on Fintech at the official Think20 Mumbai Roundtable, organised by Gateway House on 28 January 2019, could not be more timely

Courtesy: Hume Brophy

Courtesy: Hume Brophy

The global financial system has been driven by the search for profit, but serious flaws surfaced in such a myopic approach. Now, sustainable finance’s time has come—and investment decisions will benefit from integrating environmental, social and governance factors

Courtesy: Sputnik News

Courtesy: Sputnik News

Speakers at the seventh Atlantic Dialogues, held in Morocco earlier this month, discussed what the challenge to western dominance and China’s expansionism meant for their political and economic future

Courtesy: Gateway House

Courtesy: Gateway House

The Think20 Inception conference, held in Tokyo on December 4-5, 2018, kicked off the research process for 2019 for the leading think tanks from G20 countries that work on issues of global economic governance. The author participated in the conference as an observer.

Courtesy: NTNU

Courtesy: NTNU

The emergence of the Fourth Industrial Revolution depends on the availability of rare- earth minerals, which occur extensively on the ocean floor of the Indo-Pacific. The technology to exploit this is available only to some countries currently: the global agreement on this must be fair and safeguard India’s future interests, says the author of this blog

Courtesy: Competitive India

Courtesy: Competitive India

'Strategic OFDI’ is outward foreign direct investment made by nations in their strategic interests. China leads the way, but the U.S. has also just announced a new agency for strategic OFDI. It will now gain increasing salience in global foreign policy.

Courtesy: Lifeforex

Courtesy: Lifeforex

Basing the global oil trade on the Yuan instead of the U.S. Dollar is one leg of China’s bid to convert its currency into the international reserve currency, replacing the dollar-dominated global financial architecture. But many factors impede the Yuan from reaching the maturity required for its global adoption.

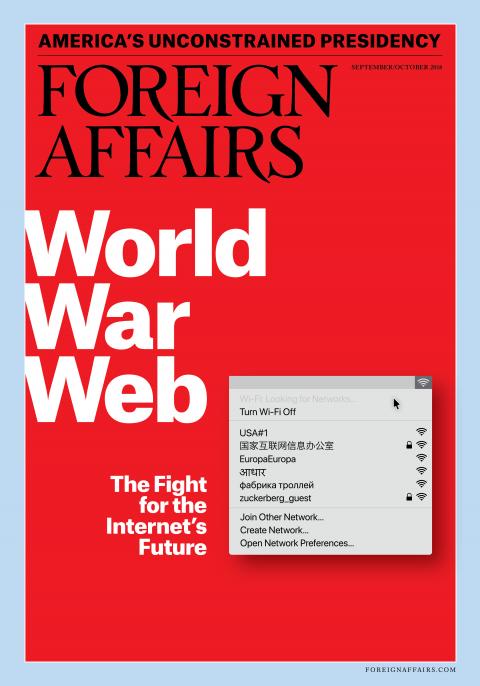

Courtesy: Foreign Affairs

Courtesy: Foreign Affairs

The immediate threat is more corrosive than explosive. States are using the tools of cyberwarfare to undermine the very foundation of the Internet: trust. The result is that an arena that the world relies on for economic and informational exchange has turned into an active battlefield.

Economist Surjit S. Bhalla, who sits on the Prime Minister’s Economic Advisory Council, says all currencies, not just the rupee, have fallen against the U.S. dollar. Speaking to Gateway House’s Manjeet Kripalani, he elaborates on some diplomatic and domestic tools to stem the fall, even in an election year