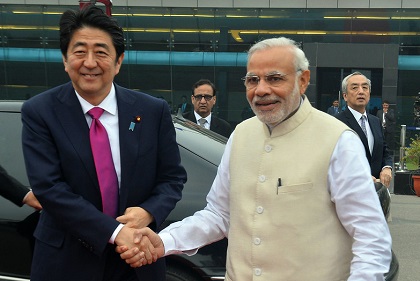

Enticing post-COVID Japan to India

Japan has determined $ 2.2 billion for rehabilitation of industries exiting China. Prime Minister Modi’s new stimulus package, close to 10% of GDP, could be the impetus Japan needs to refocus FDI to India

Courtesy: MEA/Flickr

Courtesy: MEA/Flickr

Japan has determined $ 2.2 billion for rehabilitation of industries exiting China. Prime Minister Modi’s new stimulus package, close to 10% of GDP, could be the impetus Japan needs to refocus FDI to India

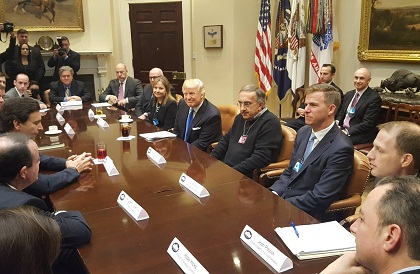

Courtesy: New York Times

Courtesy: New York Times

Three epoch-making events in 2016 are continuing to have global repercussions. They were: Brexit, China’s rubbishing of the July verdict of the Permanent Court of Arbitration after it rejected its claims on disputed islands in the South China Sea, and Trump’s election. This article, the prologue to a book-in-progress, The Hinge Year – Geopolitical Dislocations and Dispersals, outlines how these events intersect with transformed geoeconomic realities

Courtesy: Wikipedia Commons

Courtesy: Wikipedia Commons

President Trump has moved to deliver on his campaign promises with rare alacrity: his executive actions cover everything from policies on trade and energy to bringing back manufacturing to America. But he has also been walked back on some of his explosive assertions while ambiguity looms large over several issues

Courtesy: Russian Government

Courtesy: Russian Government

At a time when New Delhi is beginning to not just ‘Look East’ but also ‘Act East’, and when parallel integrative processes are underway globally, including the ASEAN-led process, the incipient China-led process and the U.S.-led TTP, India and ASEAN could together produce a brilliant new era of Asian integration

Courtesy: Quartz

Courtesy: Quartz

Regulations are the new focus of economic statecraft. Their increasing importance is reflected in the negotiations on global financial standards, plurilateral trading rules, and regional economic unions.

Courtesy: ustr.gov

Courtesy: ustr.gov

The Trans-Pacific Partnership has dropped strong Intellectual Property Rights regulations on India’s doorstep. The implications of these regulations could affect India’s own policies, as well as her global aspirations towards the potential Regional Comprehensive Economic Partnership.

Courtesy: ustr.gov

Courtesy: ustr.gov

The U.S.-driven Trans Pacific Partnership agreement between 12 countries, which is aiming to become the new standard of world trade, impacts domestic systems globally. For India, it will skew investment and intellectual property rights, and especially the debate over the Investor State Dispute System which allows companies to challenge sovereign rights and public policy.

Do the TPP and the proposed India-EU trade deal extend protection of IPR, delaying generic competition for life-saving drugs and keeping their prices high? While these and other possible implications for Indian consumers and pharma companies become clearer over time, India must robustly engage with the debate on trade deals and public interest

Courtesy: Wikipedia

Courtesy: Wikipedia

Although it is too soon to comprehensively analyse the Trans-Pacific Partnership agreement of October 5, it is worth assessing what is known. Here are the facts, the controversies, the assessments, and the implications for countries that are not part of the agreement, especially India.

Courtesy: itkannan4u/pixabay

Courtesy: itkannan4u/pixabay

External integration—which the Trans Pacific Partnership and the Regional Comprehensive Economic Partnership will generate—has policy implications that India must manage well and quickly. As a first step, India can introduce the GST, among other measures, in order to become a more unified domestic economy.