Courtesy: Institute of Peace and Conflict Studies

Courtesy: Institute of Peace and Conflict Studies

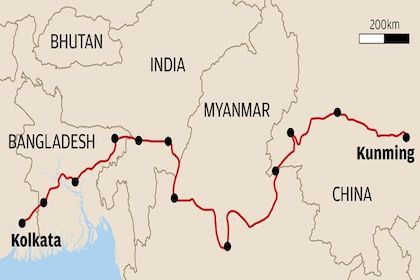

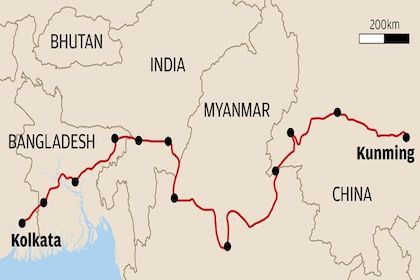

China is a clear winner in the physical connectivity stakes in the Bay of Bengal, and there's a reason a why: Its projects are connected to one another, from rail to road to port. While India also has some successful cross-border road and rail infrastructure projects, they are often an extension of an existing railway line or highway, not specific to the connectivity needs of the region. India can win by focussing instead on building infrastructure to maximise the vast maritime potential of the Bay of Bengal, especially the Andaman and Nicobar Islands that give India access to critical sea channels and trade routes.

Courtesy: Shutterstock

Courtesy: Shutterstock

The Bay of Bengal is a natural bridge between South and South-East Asia, which New Delhi seeks to optimise. But progress on India's Act East policy has been slow, creating a space for China's Belt and Road Initiative to step into. While India cannot match China’s cheque-book diplomacy, it can use its start-up industry to pursue a combination of physical, technological and financial projects to improve regional connectivity.

Courtesy: Gateway House

Courtesy: Gateway House

The Bay of Bengal is a bridge between the Indo-Pacific and the Indian Ocean, and with a population of 1.4 billion, an increasingly important economic zone in its own right. India has been slow to build regional connectivity. The space has been filled by China's Belt and Road Initiative projects, which have not always been beneficial for host countries. The region may be better off pursuing digital connectivity by enabling tech startups – areas of India’s strength. This research uses maps to explore the potential for energy, transport, and financial connectivity across the Bay of Bengal.

Courtesy: Shutterstock

Courtesy: Shutterstock

The simultaneous rise of India's tech unicorns with the unexpected crackdown by China on its star tech players, is an interesting study. India will certainly be a beneficiary of China's move, which is likely to scare foreign capital away. There's plenty on offer in India, with nearly 60 IPOs scheduled for a 2021 listing.

Courtesy: Shutterstock

Courtesy: Shutterstock

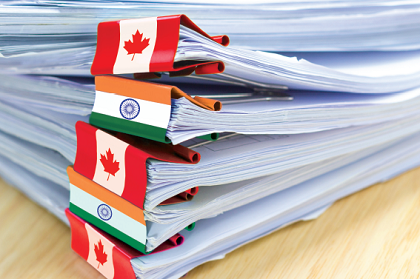

India’s oil consumption and imports are likely to resume their upward trajectory as the economy opens up, after a temporary drop due to the pandemic. To secure its energy needs, the country should shift course from investing in oil and gas assets of emerging economies to those of developed nations. The oil-rich Organisation for Economic Co-operation and Development (OECD) countries, such as Canada, Norway, and the U.S. can be given special consideration.

Courtesy: Shutterstock

Courtesy: Shutterstock

Retrospective taxes. Asking OPEC to reduce production. Raising oil prices at the pump. India’s perplexing actions on energy seem designed to defeat the Modi government’s declared goals of disinvestment of the public sector and welcoming foreign capital.

Courtesy: Shutterstock

Courtesy: Shutterstock

The ongoing turmoil in the oil markets due to the pandemic and underutilized supply, presents a long-term opportunity for India to secure its energy future. It can take small stakes in the listed oil and gas companies of stable Western democracies like the U.S., Canada and Australia, through a specially-created sovereign wealth fund. This will allow India to be better prepared for the era when prices rise again.

Courtesy: Gateway House

Courtesy: Gateway House

India’s investments in energy thus far have concentrated on buying stakes in oilfields in developing countries often at the risk of political unpredictability. With oil prices, and therefore oil company values, falling – India should revise this strategy and aim for better value and lower risk by making investments in companies in the developed world. This paper recommends investing in oil and gas assets in energy-rich developed countries like the U.S., Canada and Australia, to reduce India's vulnerability to future increases in energy prices. These should be made via a sovereign wealth fund (SWF), not the national oil companies. The SWF will be best served by acting as a financial investor, acquiring, only minority stakes, rather than aiming for management control.

Courtesy: Gateway House & CIGI

Courtesy: Gateway House & CIGI

Canada has been one of the biggest success stories in oil over the past few years. India should consider financial investments in Canadian energy assets as a means to secure its energy supplies.

Courtesy: Gateway House & CIGI

Courtesy: Gateway House & CIGI

Canada has been one of the biggest success stories in oil over the past few years. India should consider financial investments in Canadian energy assets as a means to secure its energy supplies. This paper studies the feasibility and prospects for Indian investment in Canada's petroleum sector.