Trump threats won’t change US-Pak dynamic

The Asian Age published an article written by Neelam Deo, Director & Amit Bhandari, Fellow, Energy and Environment Studies, Gateway House

Senior Fellow, Energy, Investment and Connectivity

Energy: Trade, Markets, Geopolitics & Technology; Investments; Connectivity, Infrastructure, OBOR, BRI

Courtesy:

Courtesy:

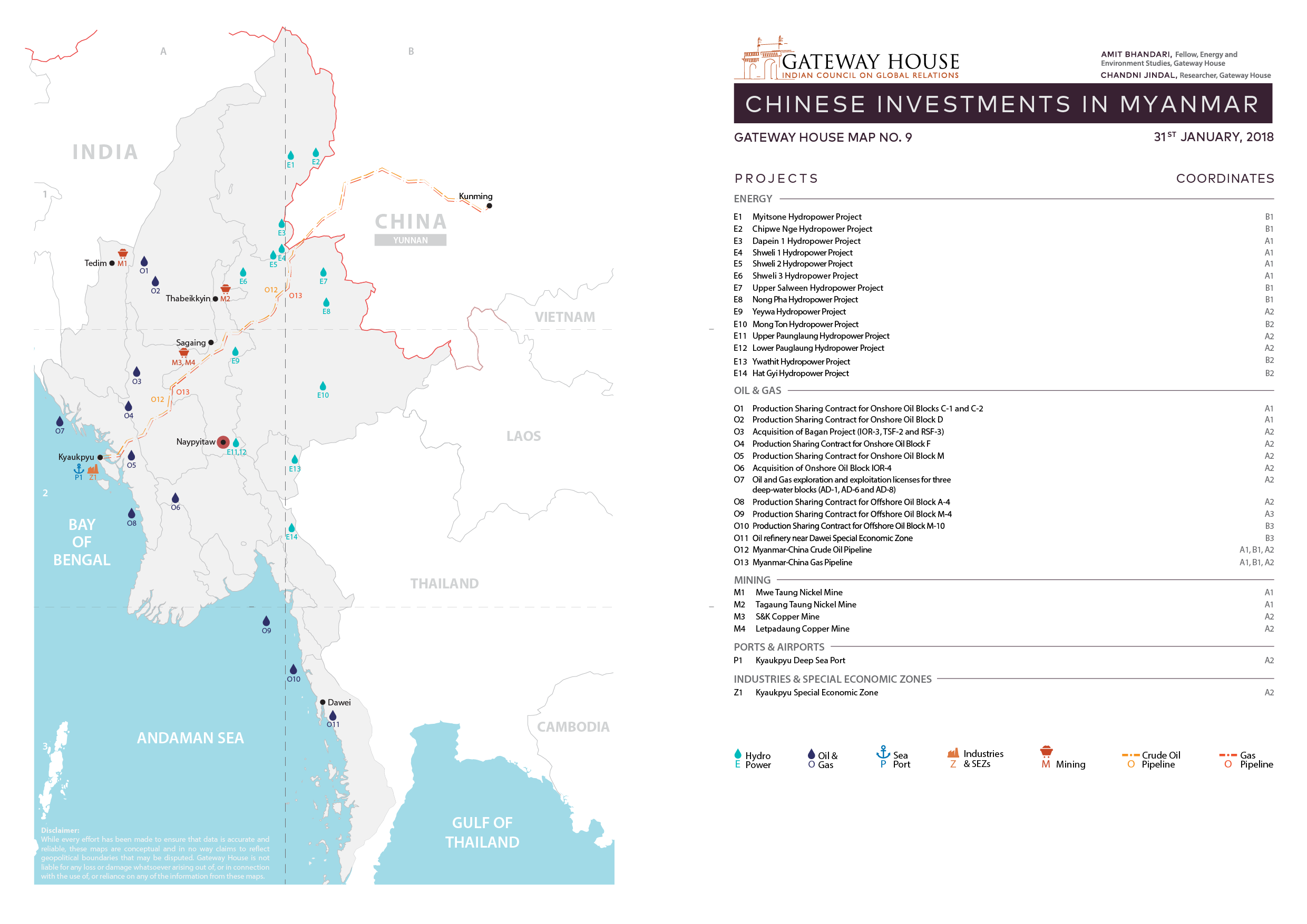

Courtesy: Gateway House

Courtesy: Gateway House

Courtesy: Gateway House

Courtesy: Gateway House

Courtesy: Gateway House

Courtesy: Gateway House

Courtesy: Gateway House

Courtesy: Gateway House

Courtesy:

Courtesy:

Courtesy:

Courtesy:

Courtesy: Gateway House

Courtesy: Gateway House

Courtesy: Asharq Al-Awsat

Courtesy: Asharq Al-Awsat

Courtesy: Wind Power Monthly

Courtesy: Wind Power Monthly