Courtesy: Wikimedia Commons

Courtesy: Wikimedia Commons

Iran’s former president Mahmoud Ahmadinejad’s disqualification from contesting the May 2017 presidential election has reduced the number of aspirants to six. The winner may well be a contender for the post of next Supreme Leader too

Courtesy: Wikipedia

Courtesy: Wikipedia

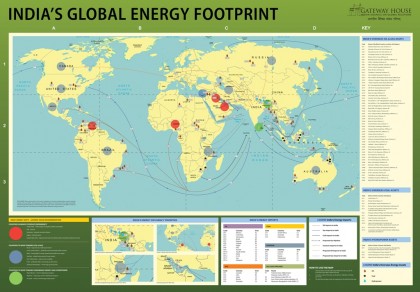

The transition to renewable energy is hampered by the lack of suitable, affordable products and specialised financing for its infrastructure. This infographic, as part of a policy brief put forth by Gateway House, set to be tabled at the 2017 Hamburg G20 conference, outlines an ecosystem to overcome these hurdles

Courtesy: Wikimedia Commons

Courtesy: Wikimedia Commons

Japanese technology giant Toshiba is sinking into a financial morass due to its near bankrupt nuclear power business, Westinghouse. India must recognise the new reality that nuclear energy is no longer financially viable

Courtesy: Gateway House

Courtesy: Gateway House

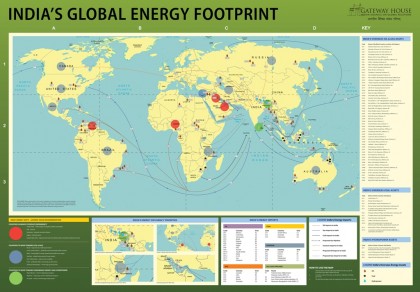

Trends in technology, geopolitics and geoeconomics have dramatically transformed the global energy scenario in the last two years. This means favourable conditions for import-dependent India, which must use the opportunities available to reduce its vulnerability to high energy prices. The jump in oil prices past the $60 mark suggests that India must act with alacrity. India’s Energy Footprint Map offers a profile of India’s global trade and investment in energy, and indicates what India can do to access cheap and reliable supplies

Courtesy: Flickr/William Munoz

Courtesy: Flickr/William Munoz

Rex Tillerson, Chairman and CEO of ExxonMobil and Donald Trump’s pick as U.S. Secretary of State, has had a long and fruitful working relationship with Russia. His experience could lubricate US-Russia relations, a development that can only benefit energy buyers like India

Courtesy: bdnews24

Courtesy: bdnews24

India imports 80% of its oil and 80% of the imports are from vulnerable regions. This high-cost, high-risk approach is not sustainable, and the current low price of oil offers India an opportunity to secure its long-term energy needs by taking three concurrent steps: diversifying supply sources, investing in oil fields, and using financial instruments

Courtesy: Wikipedia

Courtesy: Wikipedia

The Indian oil industry is changing. The recent bidding for Discovered Small Fields saw the emergence of small, independent oil explorers in a country that has been dominated by state-owned companies and only a few private sector firms

Courtesy: The Iran Project

Courtesy: The Iran Project

OPEC’s announcement of a cut in oil production shows that Saudi Arabia is being affected by low oil prices even as Iran gains ground

Courtesy: Yahoo

Courtesy: Yahoo

The sheen is coming off China’s state-owned oil companies, which have been hit by the country’s political churning and by their own excesses of buying assets at the peak of the cycle. Now with oil prices low, India has the chance to make well-priced acquisitions without Chinese competition.

Courtesy: Livemint

Courtesy: Livemint

The fall in oil prices means it is now cheaper for ONGC to acquire discovered oil fields than to explore on its own. To profit from the changed dynamic, India needs to go big on a ‘buy’ strategy.