This is part two of a two part series. You can read part one here.

While the global economy looks healthier from a macro perspective, IMF Managing Director, Christine Lagarde stated that recovery was not complete, and geopolitical tensions were rising.[1] Discussions around the meetings focused on the status of global policy reforms, especially in the United States, risks to financial stability, and the need to tackle rising inequities in many countries.

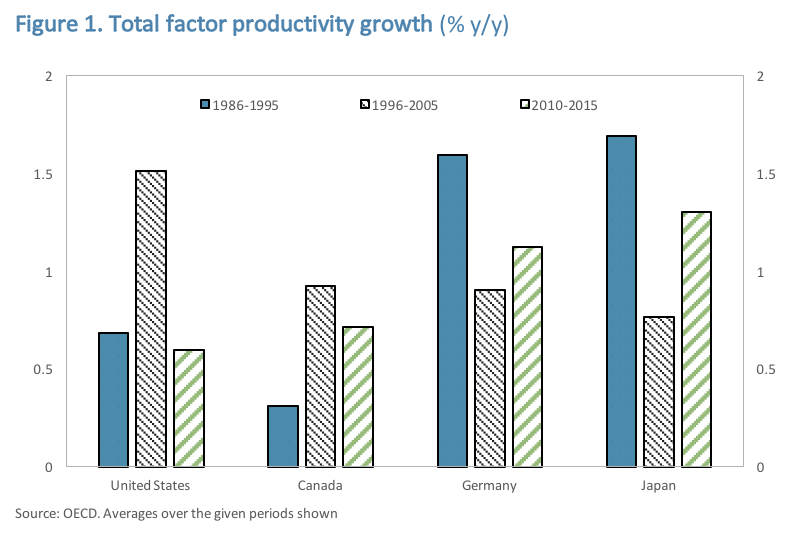

In the largest advanced economies, overall productivity growth – a measure of efficiency – has clearly dropped from pre-crisis averages (figure 1), and has likely become a key driver of low wage growth.

As a result, wages and prices have not kept pace with GDP growth, raising questions about the timing and pace of the tightening of global financial conditions. Indeed, central bank officials from the advanced countries confirmed that weak wage and inflation readings could keep them from raising interest rates rapidly. In particular, United States (US) Federal Reserve (Fed) Chair Janet Yellen signaled that future increases in the Fed’s benchmark federal-funds rate were likely to be gradual.

United States

In the United States, the problem of weaker productivity is both historical and relative to other advanced countries. As a result, there has been a significant downward trend in the labour share of income, reflecting an acute demographic decline in the labour force, driven by technical change, automation, and external competition – all strongly linked with income inequality.[2] For these reasons, in the U.S., near-term reforms to lift tax and regulatory hurdles and restore business investment and productivity have been long awaited, and they would have significant implications for other countries.

Certainly, corporate tax reform is a critical element for the U.S., given that the system is highly flawed relative to competitors, and is among the legislative priorities for the Trump administration. Briefly, at 35%, the federal rate is the highest among industrial countries, and its narrow base and inefficiency have significantly reduced its share of fiscal revenue, distorted business decisions, encouraged excessive borrowing, and deflected corporate investment to other destinations.

As such, much more needs to be done than just reducing the tax rate. What is necessary is to move to a less distorted system that increases the competitiveness of the U.S. economy and attracts investment. The proposals included in the recently announced “Unified Framework for Fixing Our Broken Tax Code” are not there yet.[3] They are far from the House Republicans’ 2016 “Better Way” plan that called for revenue-neutral tax reform, designed to would bring down rates while closing loopholes and broadening the base. The newly proposed framework risks sustainably raising the deficit and the debt, thereby outweighing the benefits from rate reductions, resulting in lower growth over time.

On the regulatory side, the debate in the U.S. has turned to rolling back the tighter financial regulations. Its outcome will have global implications, given that the Financial Stability Board, working with other financial institutions, has made significant progress since the global financial crisis to strengthen the safety of the global financial system, especially through higher levels of bank capital and liquidity. While some regulations are generally seen as needing review, there was consensus at the meetings that these needed to be given careful consideration, and global cooperation used to protect the progress that had been made, and that new risks to financial stability are addressed.

Financial stability risks

The new risks to financial stability were a key subject during the discussions: the IMF’s Financial Stability Report views them as particularly important given that global debt to GDP is now 40% higher than it was in 2008.[4] The report shows that financial stability risks have been shifting from the banking system toward non-bank institutions and sectors through technology and regulatory arbitrage. Also, that leverage in the non-financial sector in the G-20 economies, is now, on the whole, higher than before the global financial crisis. This has left the non-financial sector more vulnerable to changes in global financial conditions that likely lie ahead.

Higher debt and financial stability risks are equally of concern in Asia, where emerging markets have also experienced a sharp productivity slowdown since the global financial crisis, even as debt has generally risen. To address rising debt risks, many highly indebted countries in Asia need to harden budget constraints, remove implicit guarantees to state-owned banks and enterprises that distort the pricing of capital, and improve resource allocation to higher productivity sectors.

In China, particularly, the complexity and rate of growth in its financial system point to financial stability risks. Banking sector assets have risen from 240% of GDP at end-2012 to over 300% of GDP now. The growing use of short-term wholesale funding and “shadow credit” to firms has increased vulnerabilities at banks. The authorities have recently taken additional steps to improve risk management and transparency in the banking system and reduce corporate leverage. Addressing these vulnerabilities will require slower credit growth, and a careful balance with monetary policy.

Rising inequities

Over the longer term, the policy priority, across the regions, is to accelerate investment in people as a critical step in dealing with many of the factors leading to the socially disruptive fall in labour’s share of income. This calls for skills upgrading and investment in education that could reduce the disruptions associated with technical change. In this context, it helps that President Kim of the World Bank has called for developing a Human Capital Project that tries to go in this direction,[5] and the World Bank has also established a Women Entrepreneurs Financing Initiative (We-Fi), that will aim at unlocking the obstacles that constrain the participation of women in business activity in many emerging markets and developing countries. [6]

Overall, although the global economy’s recovery is being sustained, the discussions at the Meetings recognised that persistent weaknesses in growth fundamentals, rising debt, and concerns about how the world adapts to technological change and changing global integration, warrant much more policy attention and global cooperation.

Anoop Singh is Distinguished Fellow, Geoeconomics Studies at Gateway House: Indian Council on Global Relations.

This is part two of a two part series. You can read part one here.

This article was exclusively written for Gateway House: Indian Council on Global Relations. You can read more exclusive content here.

For interview requests with the author, or for permission to republish, please contact outreach@gatewayhouse.in or 022 22023371.

© Copyright 2017 Gateway House: Indian Council on Global Relations. All rights reserved. Any unauthorized copying or reproduction is strictly prohibited.

[1] Lagarde, Christine, ‘A Time to Repair the Rood’, speech at Harvard University, Cambridge, 5 October 2017, <http://www.imf.org/en/news/articles/2017/10/04/sp100517-a-time-to-repair-the-roof>, and

International Monetary Fund, Communiqué of the Thirty-Sixth Meeting of the International Monetary and Financial Committee (IMFC), (Washington D.C.: International Monetary Fund, October 2017) <http://www.imf.org/en/News/Articles/2017/10/14/cm101417-communique-of-the-thirty-sixth-meeting-of-the-imfc>

[2] Dao, Das, Koczan, and Lian. Why is labor receiving a smaller share of global income? IMF, Working Paper, July 2017, WP/17/169

[3] ‘A Preliminary Analysis of the Unified Framework’, Tax Policy Center, 29 September 2017, <http://www.taxpolicycenter.org/publications/preliminary-analysis-unified-framework/full>

[4] International Monetary Fund, Global Financial Stability Report October 2017: Is Growth at Risk?, (Washington D.C.: International Monetary Fund, October 2017) <https://www.imf.org/en/Publications/GFSR/Issues/2017/09/27/global-financial-stability-report-october-2017/>

[5] Jim Kim, ‘Building New Foundations of Human Solidarity’, speech delivered at Columbia University, New York, October 5, 2017, <http://live.worldbank.org/human-capital-project>

[6] International Monetary Fund, World Bank/ IMF Annual Meetings 2017: Development Committee Communique, October 14, 2017, <http://www.worldbank.org/en/news/press-release/2017/10/14/world-bankimf-annual-meetings-2017-development-committee-communique>