This feature was originally written for Where Geopolitics Meets Business, Vol. 2, the compendium for The Gateway of India Geoeconomic Dialogue.

Any assessment of the role of capital in economic development will need to take into account both recorded and unrecorded flows. Recorded flows enable governments to put the capital to productive use while unrecorded flows, leading to acts of malfeasance such as tax evasion, profit shifting by individuals and corporations, bribery and kickbacks, drain the country’s exchequer, swamping the benefits the former confers.

Hence, it is not sufficient to assess the role of capital in economic development merely in terms of recorded flows, such as official development assistance, foreign direct investment, etc. Raymond Baker, president of Global Financial Integrity, says that a comprehensive analysis will require a focus on the whole of the development equation, involving an assessment of both recorded and unrecorded capital.

Recorded capital inflows and outflows can be netted out to derive a net position. But unrecorded capital flows, which involve illicit capital in both directions, cannot be netted out because a net of illicit inflows and outflows is akin to the concept of net crime, which is logically flawed. Moreover, governments cannot tax or otherwise utilise in any meaningful way unrecorded illicit inflows. What cannot be seen cannot be taxed. Far from being a benefit to governments, illicit inflows like import under-invoicing, are a type of “fiscal termite” driving revenue loss.

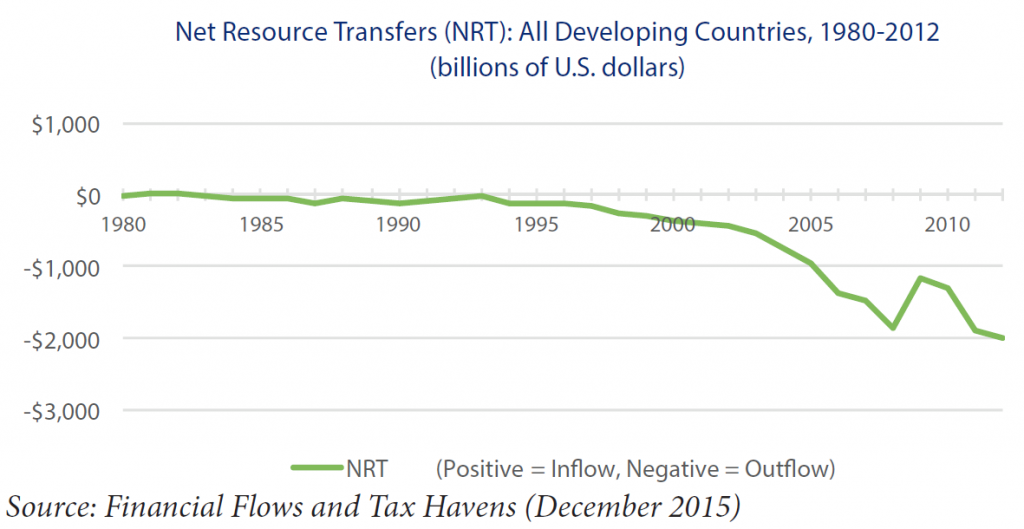

Since the late 1990s, in the wake of trade-based globalisation followed by financial globalisation, a large volume of capital began moving from developing to advanced countries. The following chart shows that relatively poor developing countries have effectively served as net creditors to the rest of the world. We arrive at this conclusion based on the concept of net resource transfers (NRT), defined as the totality of all recorded capital flows in both directions, then including outflows of illicit capital. Countries get no credit for illicit inflows for the reasons we noted. The long-term behaviour of the NRT, as captured by the chart below, is ironic from a development perspective given that capital is supposed to flow from resource-rich to resource-poor countries and not the other way around.

The graph shows that since the 1980s, there have been mostly large and sustained net transfers from developing countries in nominal terms. The loss is just as telling in terms of the GDP of developing countries, regardless of several new countries that joined the group since 1980. These countries contributed much more to net resource outflows from developing countries than they did to their GDP. It should be noted that the upward climb of the NRT into less negative territory in the period 2008-10, can hardly be called an “improvement”. In fact, subsequent developments indicate that the scenario will probably continue to deteriorate under the status quo.

Reversing this massive outflow of capital from the developing countries calls for a two-pronged approach. While governments will need to adopt sustained policies to strengthen governance in all its dimensions—including rule of law, government effectiveness, and control of corruption—closer international collaboration is needed to tighten the regulatory oversight of tax havens to promote greater transparency in their transactions and operations.

For instance, it is well known that tax havens have engaged in a race to the bottom in offering foreign investors zero or near-zero tax rates on their returns to capital, no questions asked. In fact, the legislations in tax havens have a singular focus on enhancing their attractiveness as a destination for all kinds of money. At the same time, many governments also find the ease of moving money in and out of tax havens at near-zero cost very convenient. So tax havens have an advantage over regulated on-shore banks in attracting both licit and illicit funds.

The first order of business is for governments to agree on a clear set of rules to invest in tax havens. They should consider key banking data, at par with those required of on-shore commercial banks, to be mandatory for tax havens to ensure a level playing field. Governments should also seriously consider using the business they provide to tax havens as leverage, thereby providing them a strong incentive to be more transparent regarding the deposits of licit funds by the public sector. We will then be much closer to estimating the stock of illicit funds lodged with them, which will be the first step in monitoring them through greater regulatory oversight.

For another, the use of black lists needs to reflect actual cooperation by tax havens. Presently, such lists tend to be used rather sparingly. Instead, a tax haven should be blacklisted using much more stringent criteria. There should also be punitive financial consequences for being blacklisted, such as potential withdrawal of support by a government with jurisdiction over the tax haven in the event of emergency bailouts and bankruptcies. The rationale is that a blacklisting increases the risks for mainland taxpayers should the tax haven get into financial trouble, as in the case of Cayman Islands and Cyprus in the recent past. The message is simple: comply with the prudential regulations we formulate or risk losing your “insurance”.

On a final note, international organisations like the BIS, IMF, United Nations, World Bank and its regional affiliates should also develop a system of black lists applicable to tax havens that do not conform to prudential regulations as they present a systemic financial risk. Prudential regulations also cover issues of transparency and accountability, such as requiring tax havens to exchange tax and other information with relevant governments. India should take the lead and raise these issues at the G20.

Efforts to curtail the absorption of illicit capital in the global financial system are just as important as measures to reduce the generation of those funds domestically. Both advanced and developing countries share in the responsibility of implementing this two-pronged approach given that residents of advanced countries hold around 90% of funds lodged in tax havens.

Dev Kar is the Chief Economist at Global Financial Integrity. Prior to joining the GFI, he was a Senior Economist at the International Monetary Fund (IMF), Washington DC. His career with the IMF spanned nearly 32 years.

The Gateway of India Geoeconomic Dialogue was co-hosted by Gateway House and the Ministry of External Affairs on 13-14 of February 2017. For more details on the event please click here.

This article was exclusively written for Gateway House: Indian Council on Global Relations. You can read more exclusive content here.

For interview requests with the author, or for permission to republish, please contact outreach@gatewayhouse.in.

© Copyright 2017 Gateway House: Indian Council on Global Relations. All rights reserved. Any unauthorized copying or reproduction is strictly prohibited

Notes:

This article is based on Financial Flows and Tax Havens: Combining to Limit the Lives of Billions of People; reference link: <http://www.gfintegrity.org/wp-content/uploads/2016/12/Financial_Flows-final.pdf>

The main authors of the report were Dr. Dev Kar and Dr. Guttorm Schjelderup, Professor of Economic and Business Economics at the Norwegian School of Economics. They were assisted by a number of international experts from around the world.