On 21 January, the Bombay Stock Exchange index crossed the 50,000 mark – the first ever in its 146-year history. It brought back memories of the city’s first stock market boom in 1863, and the man who began that bull run, Seth Premchund Roychand. Roychand was the poster boy of what is known today as the Bombay stock market’s first Bull Run. He was a Dosa Oswal Bania (or Vani caste of Shravak Jains) banker and broker. Roychand, at 32, was not only the face of the boom years (1863 to1865) but also became its bad guy when the bubble burst in 1865. He was blamed for the bankruptcy of scores of brokers, investors – big and small – and the winding up of the chartered presidency Bank of Bombay[1] (where he was director) and the Asiatic Banking Corporation, that he had founded in 1864.[2]

The buoyancy in Bombay’s economy began with the start of the American Civil War on 12 April 1861. The stoppage of supply of American long-staple cotton to England’s Lancashire mills, because England refused to recognize the 11 Confederate States led by General Robert E. Lee, led to a meteoric rise in demand for Deccan short staple cotton from Bombay’s hinterland, which was shipped overseas from its port. This uptick in the cotton wholesale markets[3] (total cotton exports were £80 million from 1861-65) resulted in the first big spate of new issues two years later, 46 companies incorporated in 1863 as against just four the previous year.[4] Money and credit were plentiful then and the youthful Roychand was well-positioned to make the most of these boom conditions, in fact he was a key player.

The reason why everyone in Bombay’s financial markets – European and Indian—and those outside it, took notice of Roychand’s advice and cues was because he already had a formidable reputation for being honest, knowledgeable and exceedingly shrewd. He could assess not only the markets but also the financial position of all large wealthy cotton and stock brokers. His motto: My word is my bond, adopted from the motto of the London bourse, was taken seriously by him.

On the eve of the Bull Run in 1863, he had been a registered stock broker for 14 years, had already established agencies in the cotton growing districts of Gujarat and Kathiawar where he traded and hedged, did business in cotton, bullion and shares with all the big agency houses in the city, and along with the European agency house Ritchie Stuart & Co. and other influential merchants established The Financial Association of India and China in June 1864, with a capital of Rs 1 crore. It was this financial association that was the first to ‘pioneer’ lending money against the shares of the Bank of Bombay and the Asiatic Banking Corporation (est. 1864), an exchange bank on whose board Roychand served, as also on the board of the quasi-government Bank of Bombay. His name was personally recommended by the governor of Bombay, Sir Bartle Frere.

This position of trust is what made Roychand powerful. His modus operandi, says the Bank of Bombay Commission Report, was this: ‘If Premchund had a friend to oblige, he recommended him for a loan. If Premchund had shares to sell, he would suggest to a friend that he should buy, offering at the same time to ‘finance’ the purchase money, by procuring him a loan from the Bank of Bombay. If Premchund wanted money for speculation, he would suggest to some friend to join him in it, and then procure a loan in his friend’s name for the money required. His influence was felt not only at the head offices but at the branches also, the agents at Kalbadevi, Broach and Surat all receiving instructions to consult Premchund or his agents regarding the advances’.

This dizzying web of transactions had two characteristics. One, Roychand’s name never appeared in most transactions, many being benami, or done in the name of third parties, like his accountants, peons, distant relatives. Second, he was not the only one to cotton onto the speculative potential of triangulated concerns. When a new Financial (association) was launched, a Bank helped to promote its speculation by advancing on its shares. When the Financial in turn launched a Reclamation company, it fed the frenzy jointly with the Bank.[5] The triumvirate that Roychand was most identified with was that of the Asiatic Bank –Financial Association of India and China-Backbay Reclamation Company, in all of which he was deeply involved. The introduction of time (forward) bargains about this time (then common in commodity markets like cotton) into stock trading, further fed into the stock market mania.

So frenzied was the mood during the peak year of 1864, that in the words of Sir Dinshaw Edulji Wacha, Premchund’s contemporary and biographer, “Scores after scores of men would be seen in turn going in and out of the precincts of his bungalow (Premodayan) at Love Lane[6], which was invariably accessible to all…He was never said to be in bed till past midnight.” Furthermore (says Wacha), his legions of admirers followed him everywhere, with some holding umbrellas over his head in the blazing sunshine…and, “For each one he always had a word of comfort and encouragement”.[7]

Alas, the American Civil War came to an end on 9 April 1865, and so did the demand for Indian cotton. The stock market bubble burst. When all forwards which finally matured on 1 July 1865, were squared, the outstanding dues were between £8 to £9 million. It was because so many big merchants (including Roychand) and firms failed, that the government of Bombay introduced a special bankruptcy law to expedite matters. Roychand, when accounts were tallied, personally owed the Bank of Bombay Rs 42 lakhs.[8]

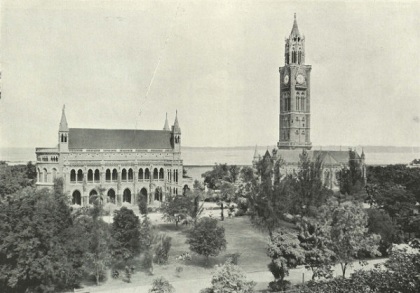

What was incredible about this messy aftermath of 1865, was that Roychand never lost his nerve unlike his contemporaries, and never reneged on any business debt or philanthropic commitment already made. The donation of Rs 4 lakhs[9] for the University of Bombay’s Rajabai Clock Tower & Library (Fort)[10] had been already promised before 1865. The clock-tower and library, an architecturally grand structure, was completed in 1878, with him remaining a single donor!

His keen interest in the education of the girl child, resulted in numerous donations to girls’ schools. In South Bombay itself, he donated to Miss Prescott’s Fort Christian School (today’s J.B. Petit High School for Girls) and the Alexandra Girl’s School.[11]

Through his life, Roychand was and remained low-key. No one ever knew the extent and depth of his business transactions, nor the extent of his charities, including his family. In retrospect, it seems the stars conspired unfairly[12] to put Roychand in the last place he would have liked to be – in the spotlight, when things went terribly wrong. Says Wacha, “had his luck carried him to the seat of wealth in London, he would have proved no mean a match for the Rothschilds, the Barings.”

Sifra Lentin is Bombay History Fellow, Gateway House.

This article was exclusively written for Gateway House: Indian Council on Global Relations. You can read more exclusive content here.

For interview requests with the author, or for permission to republish, please contact outreach@gatewayhouse.in

© Copyright 2021 Gateway House: Indian Council on Global Relations. All rights reserved. Any unauthorized copying or reproduction is strictly prohibited.

References

[1] The Bank of Bombay was recapitalized and reconstituted in 1868. To distinguish it from the old bank it was referred to as the New Bank of Bombay. Being a chartered presidency bank — the Bank of Bombay (est. 1840) — was too big to fail, and unlike other banks of the period which were wound up, it was revived with new stringent regulations. It was amalgamated in 1921 with the other two chartered presidency banks – Bank of Bengal and Bank of Madras — to form the Imperial Bank of India. After Indian independence, the Imperial Bank of India was renamed the State Bank of India.

[2] The Asiatic Banking Corporation even during its brief existence (1864-1866) opened a number of international branch offices, at Colombo and Kandy in Ceylon, and also at Singapore, Hong Kong, Shanghai and London. This bank had an initial capital of Rs. 50 lakhs (which was soon doubled) and a very influential board of directors.

[3] Rungta, R.S., The Rise of Business Corporations in India, 1851-1900 (London, Cambridge University Press, 1970), p. 72 (endnote 1)

[4] The outbreak of the American Civil War did not translate immediately into a bull run in the share market because of a ‘hesitancy’ that the war could end suddenly. Between 1 January 1861 to 31 December 1862, only nine new companies were registered in Bombay Presidency. But by 1863, complacency set in that the War would be a prolonged one, resulting in the first spate of new issues with 46 companies being incorporated that year. Ibid, Rungta, p.73. See also, Edwardes, S.M., The Gazetteer of Bombay City And Island, Vol 2 (Bombay, The Executive Editor & Secretary Gazetteer Department Government of Maharashtra, Reprint 1978), p. 166.

[5] Rungta, R.S., The Rise of Business Corporations in India, 1851-1900 (London, Cambridge University Press, 1970), p.76. According to Rungta, there were five major first class triangulated concerns on the stock market then.

See also, Edwardes, S.M., The Gazetteer of Bombay City And Island, Vol 2 (Bombay, The Executive Editor & Secretary Gazetteer Department Government of Maharashtra, Reprint 1978), p. 167.

[6] The redeveloped property is today’s Regina Pacis Center For The Integral Development Of All Girls In Need, at Mazagaon.

[7] Dwivedi, Sharada, Premchand Roychand (1831-1906): His Life and Times (Mumbai, Eminence Designs Pvt. Ltd.,2006) p. 44.

[8] Other loans procured for third parties, using his influence in the Bank included: (i) loans to third parties to purchase shares from him Rs 66,90,000/-; (ii) loans for his partners in speculation Rs 29,58,938/- (iii) plus additional loans of which two sums of Rs. 43.45 lakhs and Rs. 13.02 lakhs were irrecoverable.

[9] The offer was made by a letter dated 27 August 1864 offering a donation towards the building of a University Library, and then by a second letter of 6 October 1864 towards the erection of a Clock Tower. The total cost of the library and clock-tower came to Rs. 5,48,000/- and was covered totally by Roychand’s donation of Rs 4 lakhs and the interest accrued on that amount. Dwivedi, Sharada, Premchand Roychand (1831-1906): His Life and Times (Mumbai, Eminence Designs Pvt. Ltd.,2006) pp. 61 & 66.

[10]Roychand donated a corpus of Rs 3 lakhs in 1866 to Calcutta University, the interest on this sum was used towards an annual student scholarship, later named the Premchund Roychand Studentship (PRS).

[11] He had also donated toward the building of a Cathedral School for Girls by donating five shares of the Mazagaon Reclamation Company to the Rev. William K. Fletcher, senior chaplain of St. Thomas’ Cathedral. This money, with Roychand’s permission, was used for the repairs of the Anglican St. Thomas’ Cathedral. In Mahim, Roychand bought a large building with an extensive piece of land for the Bombay Scottish Orphanage, this was intended for the daughters of Presbyterian soldiers and Indian Navy Seamen. The boy’s orphanage and school were built later. Both institutions were merged in 1859. One condition for all the girls schools that Roychand donated to was that it must admit Indian students. For details see: Dwivedi, Sharada, Premchand Roychand (1831-1906): His Life and Times (Mumbai, Eminence Designs Pvt. Ltd.,2006) p. 71.

[12] Sir George Birdwood, Roychand’s good friend, and the then editor of The Times of India Martin Wood, strongly believed that Roychand was being made a scapegoat by the public for all the calamities that had befallen them as a result of the cotton and stock market crash. As D.E. Wacha, his biographer put it, ‘everyone had erred without exception.’