The Mombasa port is a prized national asset for Kenya. It not only facilitates the country’s shipping trade but serves as a strategic asset for the East Africa region.

The 19-terminal port operates two container terminals which manage 1.1 million Twenty Equivalent Units (TEUs) annually. The Mombasa Container Terminal (Berth 19) was constructed by the China Road and Bridge Corporation (CRBC) in 2013 while the Kipevu Container Terminal, completed in 2016, but now undergoing expansion, was funded via the Japan International Cooperation Agency (JICA)[1].

Various media reports have lately been suggesting that like Sri Lanka and its Hambantota port, Kenya will lose its highly efficient and lucrative Mombasa port to the Chinese if it defaults on its payment of Kenya Shilling 71.4 billion ($705 million) in the current fiscal period to the China EXIM Bank[2].

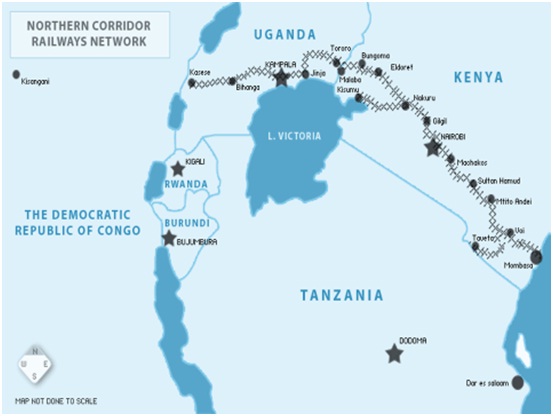

The port plays an important role in the Belt and Road Initiative (BRI) as it is the gateway to East and Central Africa. It handles imports and exports for Kenya, Uganda, Rwanda, Democratic Republic of Congo, South Sudan, and Burundi. The rail and road networks, built by the Chinese, suggests improved hinterland connectivity in Africa. This benefits the Chinese as they get access to resources in the region and increases the spread of their exports within Africa. History shows that Portuguese, Indian, Persian and Arab traders also used Mombasa as an entry point into East Africa.

A visit to Mombasa last month made plain some facts and revealed the tensions underlying increasing Chinese influence in the region. The Standard Gauge Railway (SGR), connecting Mombasa and inland Nairobi, is a part of China’s Belt and Road Initiative (BRI) and was intended to be a flagship infrastructure project for Eastern Africa,[3] but it has put Kenya into a debt trap due to high interest rates and inflated costs. The China EXIM Bank granted the $3.2 billion loan for building the railway line at an interest rate of 5.6%, to be repaid in 15 years with a grace period of five years. This is much higher than the Libor rate of 2%.

How did the Kenya Ports Authority (KPA) arrive at this point of indebtedness to the Chinese for the rail network?

The SGR was a government-to-government deal, signed on 11 May 2014. The Chinese were adamant about Mombasa port being a part of the railway line because they wanted the KPA to be the guarantor if the Kenya Railways Corporation (KRC) defaulted in its obligations. Had the Kenyan government demurred, the project would never have taken off. The Chinese then put in an additional clause, seeking that the KPA transport a minimum of 6 million tonnes of cargo annually through the railway line. Failure to do so will make the KPA liable to pay China EXIM Bank.

It is important to note that the rail line between Mombasa and Nairobi has been operational since 2017, and though being put to good use, is currently making losses.

A senior official at the KPA said that while it will promote the hub and spoke model and reduce the cost of transporting cargo, the volumes transported by the railway network will only increase significantly once the second phase of the SGR, connecting Nairobi, Kenya, and Kasese, Uganda, is completed. This will ensure larger volumes of cargo to and from the port and the hinterland. The official also mentioned that the cost of construction by the Chinese state-owned companies, China Communication Construction Company (CCCC) and its subsidiary, the CRBC, should not be inflated as was done for the first phase, an inflation that was in the ratio of 1:1000.

The 472-km Mombasa-Nairobi SGR cost the Kenyan government $3.6 billion – a very high cost, compared to the Japanese-South African deal to build the much longer 906-km SGR from Moatize coalfield in Mozambique to a deep-water port at Nacala-a-Velha in the Indian Ocean for $2.4 billion.[4]

One of the most important elements of the contract signed by the Kenya government and CRBC was the emphasis it placed on training.[5] The CCCC, to which the SGR has been contracted for the first five years, has transferred little operational know-how to the Kenyans. This is contrary to what was agreed upon. Besides, almost all jobs – locomotive drivers, truck drivers and dispatchers – are still held by the Chinese. This has led to controversy and heartburn amongst the local workers at the port. While signboards with safety warnings and other instructions are all in Mandarin, they also point out that the Chinese do not follow domestic laws when constructing or managing a project. For example, while constructing the railway line, they took the liberty of razing a section of the Kipevu Container Terminal without the KPA’s permission, which affected port operations. Port workers mentioned that some employees from the KPA were summarily fired for not cooperating with the Chinese. Those spoken to hinted at the proximity that the Kenyan leadership shares with the Chinese leadership.

China has significant investments in Kenya and is the biggest bilateral lender to the country at $52 billion in 2018.[6] The development of three berths at the deep-sea Lamu port, in Manda Bay, Lamu County, for example, is aimed at improving trade and logistics in the Ethiopian, Kenyan and South Sudan markets. The Chinese are in talks with the Kenyan government to develop the remaining 20 berths as well.

Kenya is becoming a zone of contestation, with the Japanese recently investing $356 million in loans for building the Mombasa Special Economic Zone Development Project 1 in the Dongo Kundo area.[7] Japan also provided a loan of $444 million to the Kenyan government for the Mombasa Gate Bridge Construction Project (I).[8]

U.S. Secretary of State, Mike Pompeo, who visited Addis Ababa, Ethiopia, in February 2020 for the 53rd Session of the U.N. Economic Commission for Africa, was critical of the BRI when he spoke of how the Chinese are breeding corruption, dependency, and instability in the continent, rather than prosperity, sovereignty, and progress. To counter the increasing Chinese influence in the continent, he highlighted the U.S.’ ‘Prosper Africa’ trade and investment strategy.[9]

India, which has experience of working with Japanese firms, must now step up its investment in Africa, especially East Africa. The two countries can together help develop ports and other connectivity projects in Africa. India, as host of the fourth India-Africa Forum Summit later this year, ought to use the opportunity to harness financial resources and work with its own stakeholders to consolidate ties in Africa.

Aliasger Bootwalla is Media and Outreach Associate, Gateway House

This blog was exclusively written for Gateway House: Indian Council on Global Relations. You can read more exclusive content here.

For interview requests with the author, or for permission to republish, please contact outreach@gatewayhouse.in

© Copyright 2020 Gateway House: Indian Council on Global Relations. All rights reserved. Any unauthorized copying or reproduction is strictly prohibited.

References

[1] Japan International Cooperation Agency, ‘Signing of Japanese ODA Loan Agreement with Kenya: Making goods distribution efficient through the construction of infrastructure for the Mombasa Port area, gateway to East Africa’, 5 July 2017,

https://www.jica.go.jp/english/news/press/2017/170705_01.html

[2] Chaudhury, Dipanjan Roy, ‘Kenya risks losing port to China casting shadow over India’s outreach in Eastern Africa’, Economic Times, 20 November 2019,

[3] Chinese premier wraps up “fruitful” Kenya visit with railway deal’, Embassy of the People’s Republic of China in the Republic of Kenya, 5 december 2014,

http://ke.china-embassy.org/eng/zfgx/t1184853.htm

[4] Kahyarara, Godius, ‘Maritime Transport In Africa: Challenges, Opportunities, and an Agenda for Future Research”, United Nations Conference on Trade and Development, 2018,

https://unctad.org/meetings/en/Contribution/dtltlbts-AhEM2018d1_Kahyarara_en.pdf

[5] Institute of Chinese Studies, ‘China’s Infrastructure Development in Africa’, Institute of Chinese Studies, November 2019,

https://www.icsin.org/uploads/2019/12/11/c924317a941e3d430099f6f7d652abf2.pdf

[6] Dahir, Abdi Latif, ‘China is Kenya’s largest bilateral lender’, The Atlas,

https://theatlas.com/charts/rJso30-mm

[7] The National Treasury, ‘Loan Agreement for the Mombasa Special Economic Zone Developmen Project 1′, Republic of Kenya, 27 February 2020,

[8] Japan International Cooperation Agency, ‘Signing of Japanese ODA Loan Agreement with Kenya: Making goods distribution efficient through the construction of infrastructure for the Mombasa Port area, gateway to East Africa’, 5 July 2017,

https://www.jica.go.jp/english/news/press/2017/170705_01.html

[9] U.S. Mission to the African Union, ‘Secretary Pompeo’s speech on ‘Liberating Africa’s Entrepreneurs’, Government of United States, https://www.usau.usmission.gov/slide/secretary-pompeos-speech-on-liberating-africas-entrepreneurs/