The global outlook suggests that sustaining India’s growth will depend on new sources, over and above the ones that have prevailed in the past. The weakening of trading partners’ external demand and the rising risks to globalisation will pose challenges for India. This calls for greater regional integration, especially in South Asia.

Although exports have not been a major driver of Indian growth, compared to China, India’s exports of goods and services did jump after 2000. In the case of merchandise exports, however, some momentum has recently been lost, partly reflecting external factors. Let’s examine the record and the lessons for making external trade a more consistent engine of inclusive growth and building the case for greater trade within South Asia.

Recent trade momentum

During the first decade of the 2000s, India’s goods and services exports grew at about 20% a year, [1] with its share of exports to GDP almost doubling in this period to about 25%.

The boom was most evident in India’s growing and technologically advanced service sector, the total exports significantly outstripping the performance of other emerging markets and even that of many advanced countries. Services now account for about a third of India’s total exports. Within India’s service exports, the momentum has been in the export of digital products (mainly computer services, within the “modern services” category), again much above the performance of other emerging markets.

In contrast, India’s manufactured goods exports have clearly lagged that of other emerging markets, especially China, and this is reflected in comparators related to share and product quality. Thus, India’s manufacturing exports as a share of total goods exports barely increased over this period, and the share of high-tech and medium-tech manufacturing exports in total goods exports remains substantially lower when compared to China or other emerging markets.

Geographic dispersion of trade.

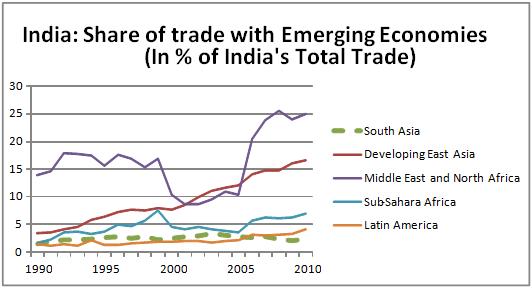

The destination of Indian exports has shifted significantly from advanced countries to emerging and developing economies. This helps contain the risks from rising protectionism. The share of exports to emerging and developing countries from India is now more than half India’s merchandise exports. Thus, Indian exports are now less dependent on advanced economies than other emerging economies. Emerging Asia’s share of India’s merchandise trade, particularly, has risen close to 20% (Chart). At the same time, India’s growing demand and purchasing power have led to substantial increases in its imports from West Asia, Africa, and Latin America, especially of natural resource commodities and agricultural goods (Chart).

Source: Based on Direction of Trade statistics, IMF

Linkages with South Asia.

There is still considerable potential to diversify the destinations of India’s trade, and build the trade engine of India’s growth.[2] This is well demonstrated by India’s significantly weak trade linkages with its immediate neighbours in South Asia (Afghanistan, Bangladesh, Bhutan, Maldives, Nepal, Pakistan and Sri Lanka). The share of trade with South Asia in India’s total trade has remained under 3%. With intra-regional trade at less than 5% of total trade, South Asia is the least integrated region in the world, dwarfed by East Asia’s 35%.

As a result, the India-South Asia trade linkages are much weaker than other comparators, such as South Africa-Southern Africa (including Botswana, Lesotho, Namibia and Swaziland) and China-ASEAN. For the South Asian economies, although India represents about 80% of the region’s GDP, the share of trade with India in their total trade volume only started to increase since the mid-1990s, and is currently less than 10% of the total. In contrast, South Africa and China have much stronger trade linkages with their neighbours with implications for their investment, productivity, and growth engines.

Thus, the potential to expand trade with South Asian countries is very large. The Research and Information System for Developing Countries (RIS) has estimated that the potential of intra-South Asia trade is about $40 billion, four times the existing formal trade.[3]

Policy commitments to build India’s trade linkages with South Asia have periodically met with little success. In 2010, the 16th South Asian Association for Regional Cooperation (SAARC) Summit called for greater regional integration to make the period 2010-2020 the ‘decade of intra-regional connectivity.’ In a similar vein, the South Asia Economic Conclave in 2015 highlighted that intra-regional trade could potentially reach 25% of the total trade conducted by South Asian countries. But this number has stagnated at a low 5%, reflecting many factors, such as lack of trade complementarity across the countries, as well as high trade costs, as manifested in tariffs, and the lack of infrastructure networks. Prime Minister Modi’s “neighborhood first” approach marks a renewed interest in building regional linkages..

Nevertheless, there have been growth spillovers to South Asia despite limited regional trade, transmitted through different channels, such as investment in energy, education, remittances, and financial linkages.[4] Also, as India is moving up the value chain—towards higher-tech and higher-value goods and services—this is creating opportunities for its neighbours to integrate themselves with India’s supply chain, also making it a destination for higher education in the region.[5]

Implications for policies and growth

The scope for trade integration in South Asia is, therefore, quite large, and both India and its South Asian neighbours can benefit from strengthening such intra-regional ties. To exploit this potential, key policies include, reducing trade restrictiveness and improving the infrastructure and business environment across the region, with much more flexible labour laws. India’s Overall Trade Restrictiveness Index, which measures the weighted average tariff, is still high relative to other G20 economies, including South Africa and China. Greater challenges exist, however, from non-tariff measures/barriers, excessive bureaucracy, weak trade facilitation, and customs inefficiencies.[6]

To enable larger gains, cooperation should go beyond goods trade and include investment, finance, services trade, trade facilitation, and technology transfer, and be placed within the context of regional cooperation. In particular, there needs to be much greater policy coordination between trade and foreign direct investment initiatives. Taking the experience of other regions, regional trade integration usually goes hand in hand with regional investment to build supply chains. Besides, trade in education and health care services offers valuable prospects.

South Asia’s potential is unquestionable: education levels are on the rise, more than one million young workers enter the labour market each month, and the population of the region’s mega cities is expanding significantly. By 2030, more than a quarter of the world’s working adults will live in South Asia. In contrast, the work force is aging and labour costs are rising in China and many other East Asian countries, opening room for new supply chains in other regions.

To meet the challenges from these demographics, maintain social stability, and realise the region’s potential, it will be imperative to increase regional and global integration, and deepen supporting reforms, especially in education and infrastructure. These reforms will also improve the capabilities of regional firms to participate in regional and global value chains.[7] There is also evidence that greater trade integration will lead to reductions of poverty and inequality, and build more inclusive growth.[8]

Anoop Singh is Distinguished Fellow, Geoeconomics Studies at Gateway House: Indian Council on Global Relations.

This article was exclusively written for Gateway House: Indian Council on Global Relations. You can read more exclusive content here.

For interview requests with the author, or for permission to republish, please contact outreach@gatewayhouse.in.

© Copyright 2017 Gateway House: Indian Council on Global Relations. All rights reserved. Any unauthorized copying or reproduction is strictly prohibited

References

[1] Anand, Rahul, Kochhar, Kaplana, Mishra, Saurabh, Make in India: Which Exports Can Drive the Next Wave of Growth, International Monetary Fund Working Paper, 2015, <https://www.imf.org/external/pubs/ft/wp/2015/wp15119.pdf >

[2] De, Prabir, Global Economic and Financial Crisis: India’s Trade Potential and Future Prospects, United Nations Economic and Social Commission for Asia and the Pacific Working Paper, 1 May 2009, <http://www.unescap.org/sites/default/files/AWP%20No.%2064.pdf>

[3] Research and Informational System for Developing Countries, South Asia Development and Cooperation Report 2015: Economic Integration for Peace-Creating Prosperity, 2015, <http://ris.org.in/sites/default/files/pdf/RIS%20SADCR-2015%20Executive%20Summary.pdf>

[4] To give an example, a key driver has been India’s increasing demand for energy. India’s investment in Bhutan’s hydropower projects has helped generate substantial hydropower export earnings and strong growth dividends for Bhutan. In Bangladesh, India is jointly developing thermal power generation facilities

[5] The number of South Asian students in Indian universities has more than doubled since the early 1990s, as explained in Dongaonkar, Dayanand, Negi, Usha Rai, International Students in Indian Universities 2007-2008, Association of Indian Universities, 2009.

[6] Trade Policy Review Body, World Trade Organization, Trade Policy Review: India, 10 August 2011, <https://docsonline.wto.org/dol2fe/Pages/FE_Search/FE_S_S009-DP.aspx?language=E&CatalogueIdList=134359,131826,92476,107561,81496,25701,42365,75303&CurrentCatalogueIdIndex=3&FullTextHash=&HasEnglishRecord=True&HasFrenchRecord=True&HasSpanishRecord=True >

[7] Lopez-Acevedo, Gladys, Medvedev, Denis, Palmade, Vincent, South Asia’s Turn: Policies to Boost Competitiveness and Create the Next Export Powerhouse, Washington DC: World Bank, 2016

[8] Mishra, Prachi, Kumar, Utsav, Trade Liberalization and Wage Inequality: Evidence from India, International Monetary Fund Working Paper, January 2005, <https://www.imf.org/external/pubs/ft/wp/2005/wp0520.pdf>