The world has long accepted the U.S. dollar as an international reserve currency, but its position as the world’s dominant currency is now coming under pressure. The recent meeting of the BRICS nations, which agreed to trade with each other in their own currencies[1], has posed an immediate challenge to the internationally accepted status of the U.S. dollar and its global influence. Countries and central banks around the world are actively exploring alternative methods to reduce their reliance on the U.S. dollar due to its weakening monetary standing, and pursue a risk-free monetary policy.

The dependence on a single currency poses risks to a country’s monetary system, increases the cost of international trade, and widens the fiscal deficit. These risks are exacerbated by geopolitical tensions associated with U.S. foreign policy actions, such as the recent conflict between Ukraine and Russia, sanctions on Iran, Russia, China and other, U.S. involvement in the Iraq and Afghanistan wars, trade barriers against China’s exports to the U.S. market, supply chain de-risking, and efforts to reduce dependency on China’s factories.

The recent collapse of U.S. banks, including the Silicon Valley Bank (SVB), First Republic Bank, and Signature Bank, have also eroded trust in the U.S. monetary system.[2] Rising inflation is undermining confidence in the U.S. dollar. Oil and commodities giants like Russia and Saudi Arabia have already engaged in energy trade using non-dollar currencies[3], while Argentina and Brazil are considering a common currency for South America.[4]

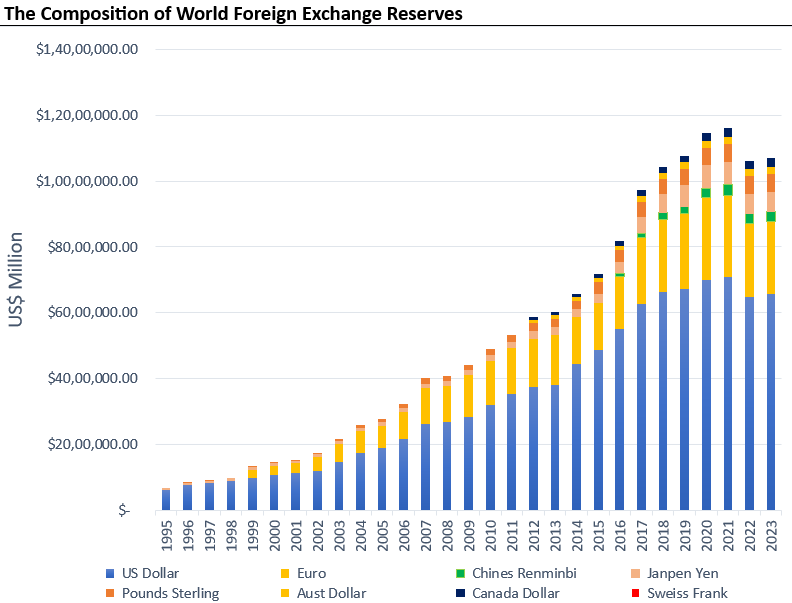

Consequently, central banks are eager to diversify their reserve compositions, opening the door to opportunities for the Yuan and other new currencies. Through its Belt and Road initiative, China, the world’s largest exporting economy, has been promoting the use of the Chinese renminbi as an international trading currency among countries that have entered into bilateral agreements, debt relationships, and currency swaps. This has led to a significant increase in the reserve holdings of the Chinese Yuan. China and Russia now conduct their oil and energy trade using the Yuan and the Ruble.[5] The world’s foreign exchange reserves in Chinese Renminbi have surged from US$ 90 billion to $ 228 billion between 2016 and 2023 (IMF of Reserve Data), representing a significant market share capture.

This chart shows the composition of world foreign exchange reserves. The Japanese Yen has maintained a sustainable share of reserves, whereas the Euro has yet to accelerate to secure its expected competitive position alongside the U.S. dollar. Additionally, the Pound Sterling is also retracting its position due to slow economic growth. The Yuan is not yet convertible and is still pegged to the U.S. dollar.

For the Yuan to be independent, China must build confidence among central banks and global investors worldwide by opening up its market, strengthening the financial system and enhancing its transparency and independence.

India has expressed interest in using the Rupee as an international currency, a topic that discussed during the state visit of Sri Lankan President Ranil Wickremesinghe to India. Developing countries like India will benefit from reducing vulnerability to U.S. monetary policy, improve their financial position through diversified currency reserves, and potentially dominate the Indo-Pacific region by promoting the Rupee as a trading currency among bilateral and multilateral friendly nations. It will determine the risk-taking capacity to be party to de-dollarization, as that can introduce significant risks to developing countries’ trade balances.

The decline of the U.S. currency’s dominance is decades away – if at all. The U.S. is still the largest economy in GDP value[6], is the second-largest exporter in the world[7] , maintains a strong monetary policy, and dominates nearly 60% of the world’s foreign reserves. It remains the leader in the global financial markets. Still, the challenge to the U.S. dollar-denominated international monetary system has begun and disrupted the uniform currency system, leading to a more diversified foreign reserve currency.

Kamalaharan Shanmugam is Research Assistant, Gateway House.

This article was exclusively written for Gateway House: Indian Council on Global Relations. You can read more exclusive content here.

Support our work here.

For permission to republish, please contact outreach@gatewayhouse.in

©Copyright 2023 Gateway House: Indian Council on Global Relations. All rights reserved. Any unauthorised copying or reproduction is strictly prohibited.

References

[1] XV BRICS Summit Johannesburg Declaration, Aug 23, 2023, https://mea.gov.in/Images/CPV/Declaration_2408.pdf.

[2] Drew Desilver,‘Most U.S. bank failures have come in a few big waves.’ Pew Research Centre, Apr 11, 2023, https://www.pewresearch.org/short-reads/2023/04/11/most-u-s-bank-failures-have-come-in-a-few-big-waves/.

[3] Nidhi Verma, ‘India refiners start yuan payments for Russian oil imports,’ Reuters, Jul 3, 2023, https://www.reuters.com/business/energy/india-refiners-start-yuan-payments-russian-oil-imports-sources-2023-07-03/.

[4] The Gateway House Podcast, ‘Common Currency for an integrated South America,’ Feb 9 2023, https://www.gatewayhouse.in/common-currency-integrated-south-america/.

[5] Ji Siqi, ‘China-Russia gas deal in yuan, roubles underscores efforts to reduce US dollar hegemony,’ Sep 7, 2022, https://www.scmp.com/economy/article/3191686/china-russia-gas-deal-yuan-roubles-underscores-efforts-reduce-us-dollar.

[6] IMF Data, Accessed on 02nd September 2023 to macroeconomic and financial data, https://data.imf.org/?sk=e6a5f467-c14b-4aa8-9f6d-5a09ec4e62a4.

[7] IMF Data, Accessed on 02nd September 2023 to macroeconomic and financial data, https://data.imf.org/?sk=e6a5f467-c14b-4aa8-9f6d-5a09ec4e62a4.