The state visit of Sri Lanka’s President Ranil Wickremesinghe to the United Arab Emirates (UAE) for the COP28 summit on Dec 1, 2023 was an opportunity to attract foreign investment for his own country and to make a broader pitch for commercial investment for developing countries. The latter was presented through his Tropical Belt Initiative[1] that aims to foster sustainable development through public-private partnerships in developing nations. For Sri Lanka, he emphasised the need for $12 billion in foreign investment in renewable energy sources by 2030 to fulfill the country’s COP commitment.

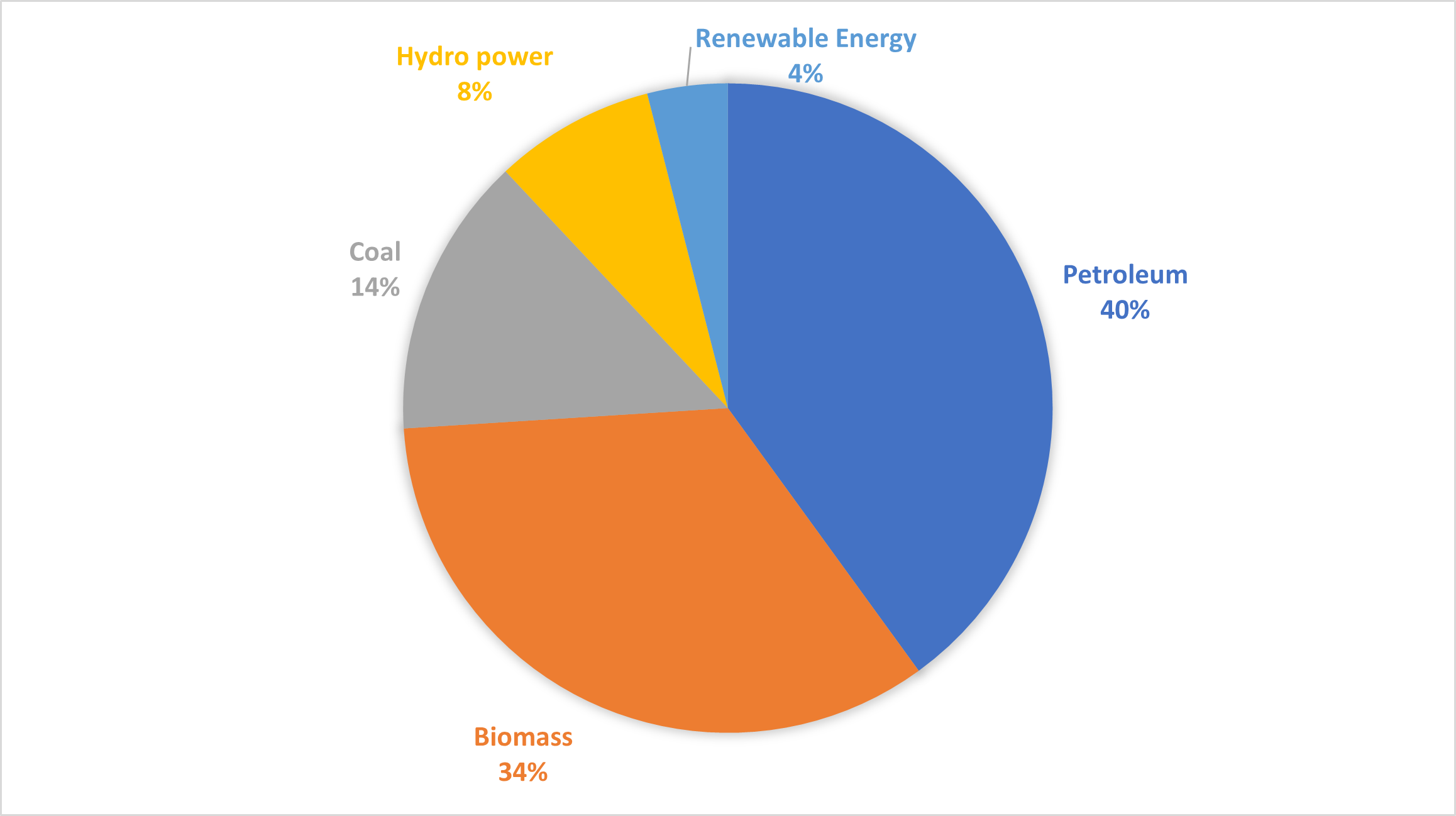

The energy initiative has already garnered interest from Saudi Arabia and the UAE. If it translates into a substantial investment, it will significantly contribute to the recovery of Sri Lanka’s economy. A lack of capital and technology has meant that Sri Lanka has struggled to adhere to the global order’s shift from dependency on fossil fuels to renewable energy.

The energy sector plays a pivotal role in the economy. Since 2019, ensuring a consistent and uninterrupted electricity supply has become the signal challenge for Sri Lanka, particularly for the industrial and commercial sectors. The cost of energy has been steadily on the rise, impacting the overall cost of living, production costs, and ultimately influencing export prices.

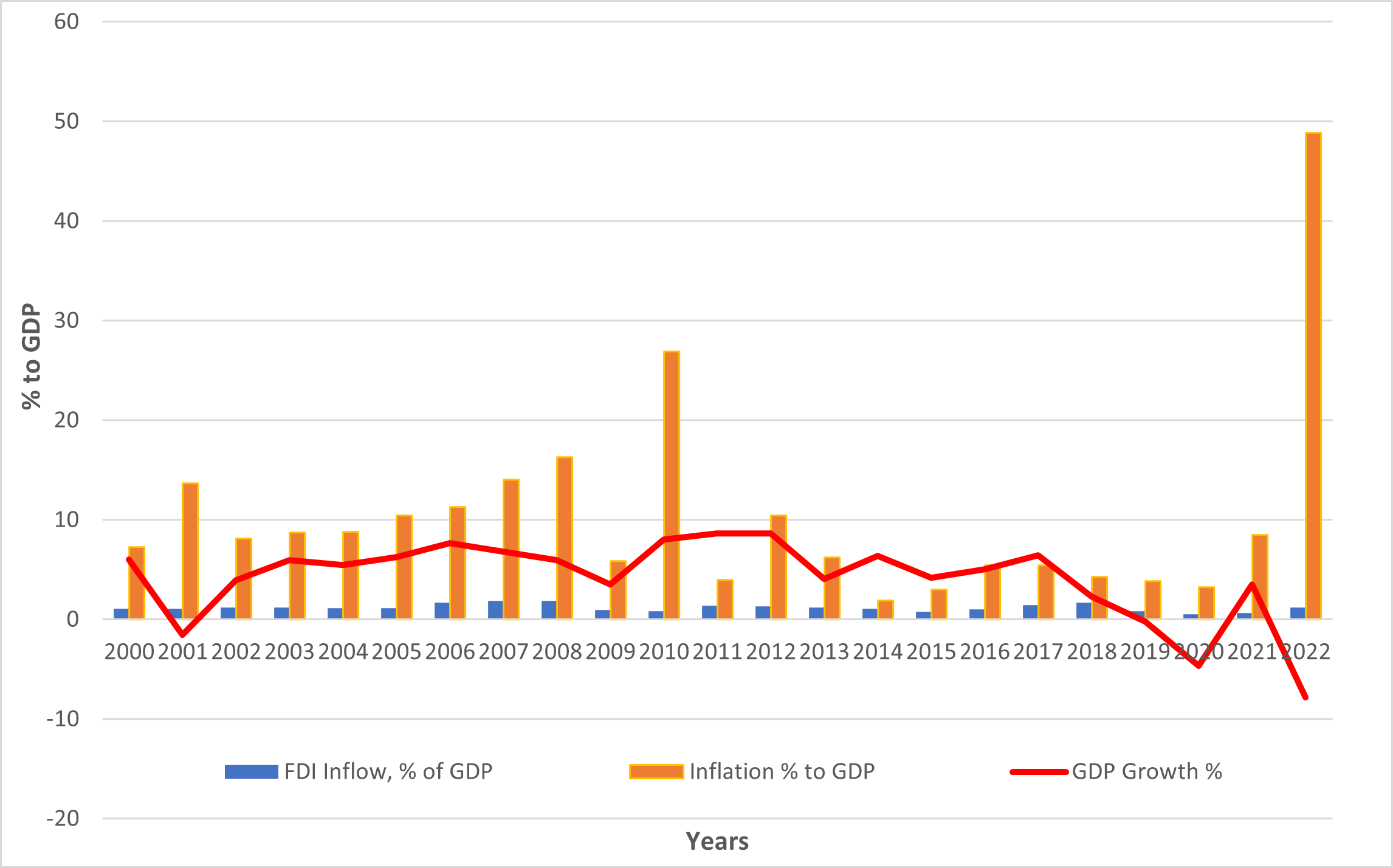

Not helpful is increased government spending particularly on state-owned enterprises resulting in foreign exchange outflows, increased inflation and higher wages. The ensuing economic upheaval, marked by a foreign exchange crisis that led to a default on debt, has adversely affected the appeal of Sri Lanka to foreign investors. This diminished allure is evident not only in a reduced interest from new investors but also from existing investors in sectors like textiles, the equipment industry and information technology shifting their focus to neighbouring nations.

Foreign direct investment (FDI) therefore plays a pivotal role in the Sri Lankan economy. FDI yields substantial benefits, generating employment opportunities, uplifting unskilled labour to skilled levels, facilitating the transfer of knowledge and skills, and augmenting overall productivity. Research studies centred on East Asian countries indicate that FDI has had a positive impact on the region’s economy, transforming it into a robust hub for trade and investment. Export-led FDI in particular, can contribute to an early settlement of debt and bring sustainable growth to Sri Lanka.

Sri Lanka’s average annual FDI inflow of $800 million[2] is significantly lower than that of its neighbours, namely India, Bangladesh, and Pakistan. The accumulated FDI has been distributed across infrastructure development (64%), manufacturing (21%), and services (15%). The textile and apparel industry alone comprises 38% of the FDI in the manufacturing sector.

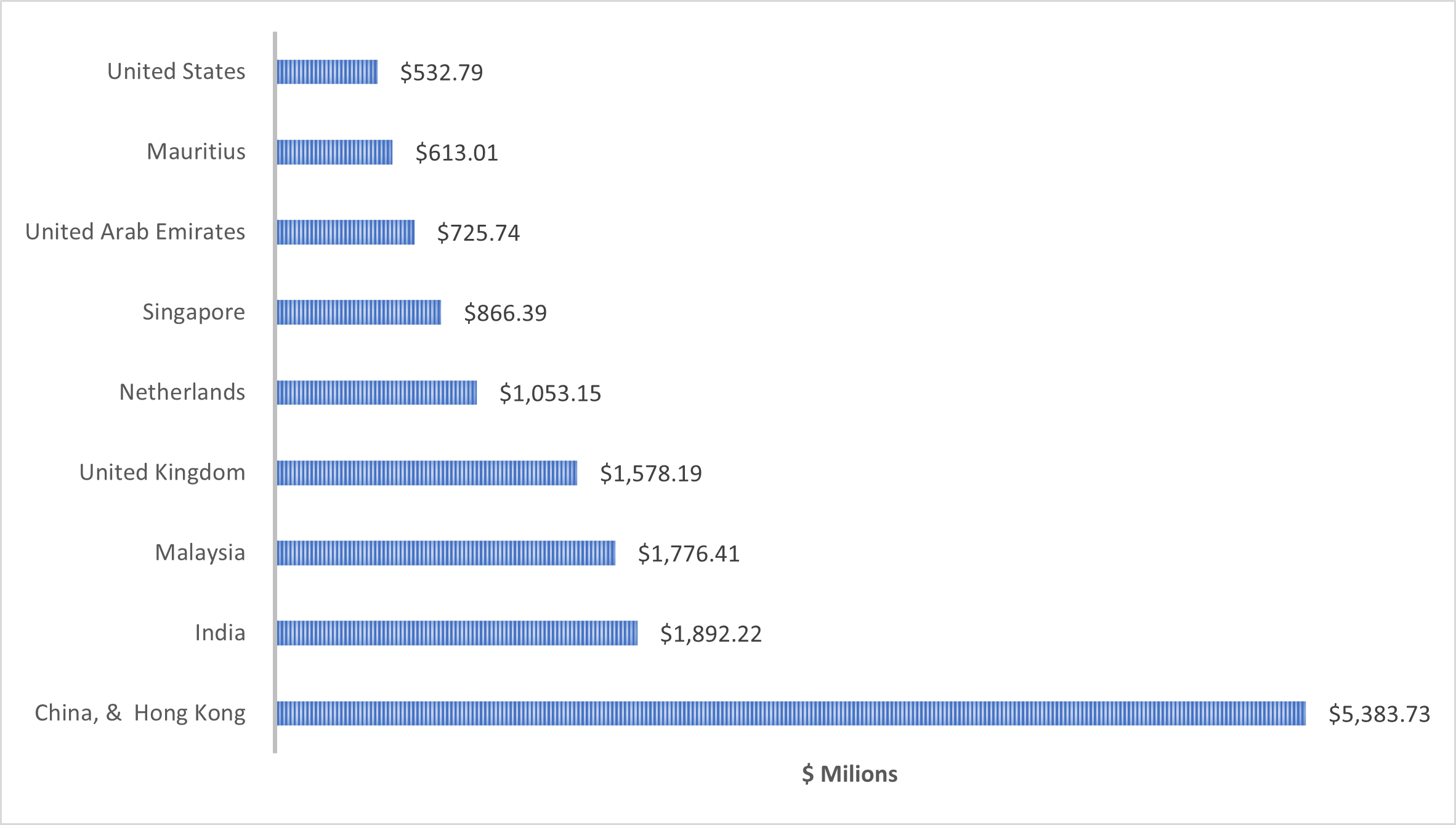

The two countries with an interest in FDI in Sri Lanka, are India and China. China’s investment in infrastructure development amounted to $12.1 billion from 2006 to 2019, constituting 14% of Sri Lanka’s GDP in 2018. [China retains a significant portion of Sri Lanka’s foreign debt, amounting to $35 billion until 2021.

China’s substantial investment in infrastructure has proven burdensome for the economy, marked by a dearth of returns on investment and productivity. Endeavours such as the Hambantota Port, Mahinda Rajapaksha International Airport, Colombo Lotus Tower and the Norochcholai coal power plant have exacerbated this challenge as they are straddled with low productivity, low or no return on investment but nonetheless require Sri Lanka to pay off the loan and interest thereon.

| Composition of Sri Lanka’s Foreign Debt Settlement | |

| Foreign Debt | Maturity Period |

| 37% of FD | Within 5 Years |

| 51% of FD | 6 to 10 Years |

| 12% of FD | After 20 Years |

| Source: Foreign Debt Summary, Department of External Resources, Government of Sri Lanka, https://www.erd.gov.lk/index.php?option=com_content&view=article&id=102&Itemid=308&lang=en. | |

India’s investment in Sri Lanka from 1995 to 2022 is $2.2 billion, while the Indian government’s loan in 2023 is $5 billion. Greater Indian investment is desirable, as it can play a significant role in Sri Lanka’s FDI basket, especially in energy. Some of this is starting to happen. India’s big players like Adani have already invested $750 million in renewable energy projects. Having small and medium-sized Indian investors follow in investing in Sri Lanka, will provide stability and sow the early seeds of regional intra-investment.

Sri Lanka has much to offer: strategic geographical connectivity to global trade through shipping routes and air transportation, positioning itself as a potential logistics hub. The Colombo port has witnessed remarkable growth: 6% from 2021-22, a high cargo capacity throughput of 7.5 million TEUs; it now ranks 22nd among the world’s top ports. It remains unrivalled in South Asia.[3] Energy is key to its growth: Reducing electricity costs and providing uninterrupted power supply will enhance the efficiency of port operations.

Sri Lanka must now work hard to enhance its overall business environment, beyond offering tax concessions and exemptions. The key is to eradicate corruption and ensure political stability, laying the foundation for an effective and progressive FDI and trade strategy. The existing FDI policy, which predominantly favours infrastructure development and hence Chinese investment, needs to be revisited to focus on renewable energy and manufacturing.

Most important, the country should carefully expand the free trade agreements (FTAs) it has signed with both Western and ASEAN investors. That, and forging closer ties with both India and China, will certainly contribute to a more robust investment climate.

Kamalaharan Shanmugam is Research Assistant, Gateway House.

This article was exclusively written for Gateway House: Indian Council on Global Relations. You can read more exclusive content here.

Support our work here.

For permission to republish, please contact outreach@gatewayhouse.in

©Copyright 2024 Gateway House: Indian Council on Global Relations. All rights reserved. Any unauthorised copying or reproduction is strictly prohibited.

References

[1] ‘Launch of the Tropical Belt Initiative,’ Ministry of Environment, Government of Sri Lanka, https://www.env.gov.lk/web/index.php/en/announcements/campaigns/299-launch-of-the-tropical-belt-initiative#:~:text=The%20launch%20of%20the%20Tropical,former%20Prime%20Minister%20of%20Australia.

[2] CBSL. (2023, October 06). Central bank of Sri Lanka, Data Library. Retrieved from www.cbsl.lk: https://www.cbsl.lk/eresearch/

[3] World Bank. (2021). Transport Globe Parctice The Container Port Performance Index. Washington, DC: The World Bank.