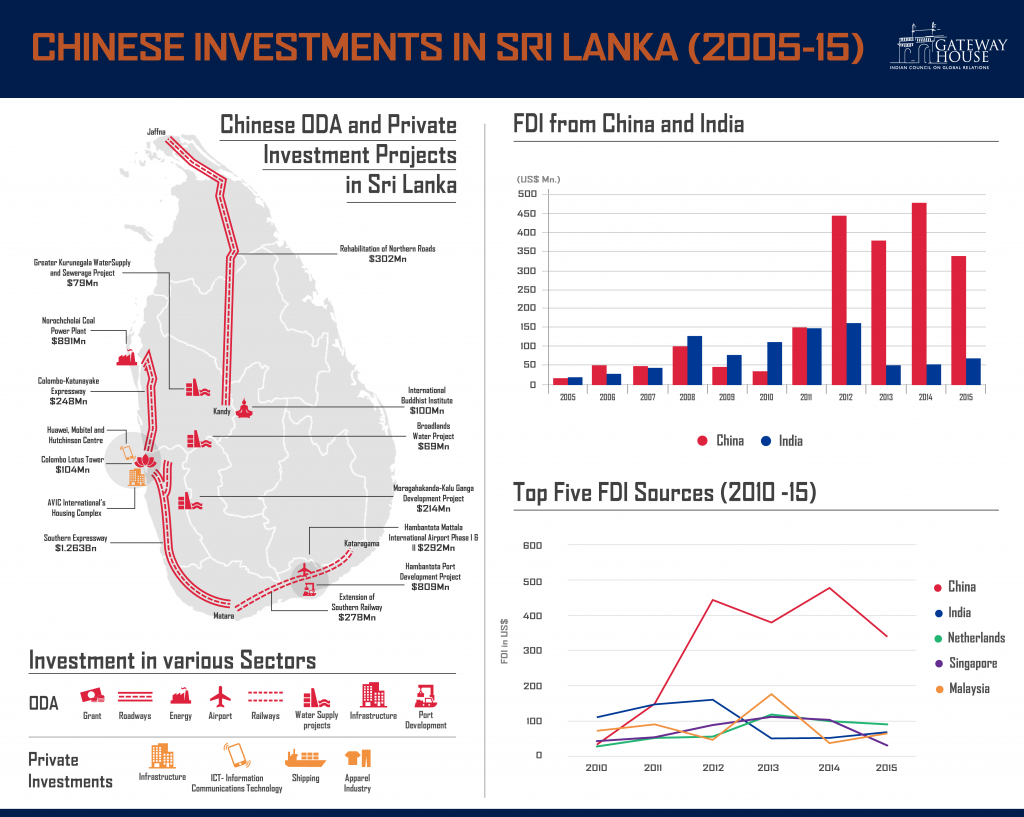

Over the decade starting 2005-2015, China has emerged as the leading source of Official Development Assistance (ODA) and Foreign Direct Investment (FDI) in Sri Lanka–$14 billion. Most of it is ODA in loans and grants–$12 billion in sectors like energy, infrastructure and services. There is private Chinese investment too–$2 billion and growing.

China’s flagship projects are the Hambantota Port Development and the Colombo Port Project, both supported by loans and located at strategic points on the global sea trade route. Much of the infrastructure project funding comes through Chinese government companies. For example, the $1.3 billion Norochcholai Coal Power Plant is being built by the China Machinery Engineering Corporation, and Hambantota’s $1 billion in loans comes from the China Harbour Engineering Company Ltd and Sino-Hydro Corp, both of which are building the port. Large projects like these make it easier for Beijing to draw Sri Lanka into its 21st Century Maritime Silk Road project, all part of the One Belt, One Road initiative.

There is significant Chinese private money too, largely from Hong Kong, This capitalises on Sri Lanka’s cheap and productive labour as also the island nation’s coveted access to the South Asian, EU and American markets. The prominent investors are mostly Hong Kong billionaires, including Lai Weixuan’s AVIC International Hotels Lanka which is investing $250 million in luxury housing in Colombo, Robert Kuok’s Shangri-La Hotels Lanka which has $16 million in a five-star hotel in Colombo, and Li Ka-Shing’s Hutchison Telecommunication which is spending $20 million on improving its already large mobile network in Sri Lanka.

Overall, China’s FDI has clearly overshadowed that of other countries in the island nation. In 2005, China’s FDI into Sri Lanka was $16.4 million, or just under 1% of total Sri Lankan FDI. By 2015 Chinese private investments reached $338 million, constituting 35% of Sri Lanka’s total FDI. In contrast, the Netherlands’ share of FDI was 9%, India’s, like Malaysia’s, was 7%, and Singapore’s only 3 per cent.

These large private investments have enabled Chinese companies to gain local market dominance. For instance, Huawei, the world’s largest telecom equipment manufacturer, entered the Chinese market in 2005 and is now the second-largest player with an estimated 24% share of the smartphone market.[1]

This dominance is evident in development assistance as well. In 2005, ODA from China was $10.5 million – just 1% of total ODA to Sri Lanka, a distance from the major ODA provider then, Japan with $238 million, or 23% of total ODA, with India trailing at $7.4 million.[2] By 2015, China had become the largest provider of ODA to Sri Lanka at $12 billion, with a long lead over India’s $1.9 billion,[3] and Japan’s $175 million.[4]

China’s ODA in infrastructure clearly has a security and commercial imperative, but it has a strategic cultural and socio-political dimension too. For instance, Beijing made a grant of $100 million in 2009 to develop the international Buddhist Institute near one of Sri Lanka’s holiest shrines in Kandy to attract Buddhist pilgrims and students.

China’s financial engagement with Sri Lanka is likely to deepen starting next year, 2017, with Beijing and Colombo readying to sign a Free Trade Agreement (FTA), one which has been negotiated since 2014. The lower tariffs will enable Chinese products to penetrate deeper into Sri Lanka’s consumer market, widening China’s already huge $3.4 billion trade surplus with that country. Colombo is already indebted to Beijing to the tune of $9.6 billion, given at interest rates of between 2% and 5%, and falling behind repayments.[5]

China’s intensifying investments in Sri Lanka have not gone unquestioned within the country. Many opposition parties criticised former president Mahinda Rajapaksa for developing an over-reliance on China for infrastructure financing, and for accumulating debt. But the Chinese imperative is compelling; the Indian government and private players cannot compete with the size of Chinese investment capacity. The criticism of Rajapaksa notwithstanding, current president Maithripala Sirisena has found himself continuing to seek Chinese investment to finance his ambitious infrastructure buildout.

The Sirisena-led government wants to balance the political relationship between India and China. Sirisena has, in the last two years, made four visits to India and secured $414 million in loan agreements and grants from New Delhi. In the same time, he has visited Beijing once, and received loans and grants of $438 million. Clearly, Sri Lanka has found a way to position itself in the region smartly enough to gain goodwill and funds from both its giant Asian neighbours.

Disclaimer: Foreign investments in Sri Lanka have been tracked primarily from the Annual reports of the Central Bank of Sri Lanka available from their website. The disbursement amounts of ODA to Sri Lanka were sourced from the External Resources Department and the Central Bank of Sri Lanka.The data relating to the financial commitments to Sri Lanka either announced or provided by China including development assistance for infrastructure and water projects was obtained from the website Aid Data. The FDI data was not available online and was gathered from the Board of Investment of Sri Lanka.

Rajiv Bhatia is Distinguished Fellow, Foreign Policy Studies Programme, Gateway House, and a former ambassador to Myanmar.

Kunal Kulkarni is a Senior Researcher at Gateway House.

Lina Lee is a research intern at Gateway House.

Shivani Gayakwad is a research intern at Gateway House.

Designed by Debarpan Das

This infographic was exclusively created for Gateway House: Indian Council on Global Relations. You can read more exclusive content here.

For interview requests with the author, or for permission to republish, please contact outreach@gatewayhouse.in.

© Copyright 2016 Gateway House: Indian Council on Global Relations. All rights reserved. Any unauthorized copying or reproduction is strictly prohibited.

References

[1] ‘We will further invest in Sri Lanka: Huawei Country Head Henry Liu’, DailyFT, 28 September 2016, <http://www.ft.lk/article/570172/-We-will-further-invest-in-Sri-Lanka—Huawei-Country-Head-Henry-Liu>

[2] Department of External Resources, Government of Sri Lanka, Foreign Aid Review 2005. p.18 and p.23, <http://www.erd.gov.lk/publicweb/FAR2005/Foriegn%20Aid%20Review-2005.doc>

[3] The figure is compiled by Gateway House research based on information from the Central Bank of Sri Lanka Annual Reports 2005-2015, <http://www.cbsl.gov.lk/htm/english/10_pub/p_1.html>

[4] Department of External Resources, Government of Sri Lanka, Performance Report 2015. p.7 <http://www.erd.gov.lk/files/3.%20Performance%20Report%202015%20-%20English%20Version.pdf>

[5] Department of External Resources, Government of Sri Lanka, Foreign Aid Review Report 2005 and Performance Reports 2006-2015. < http://www.erd.gov.lk/publication.html>