On September 4, Raghuram Rajan took over from Duvvuri Subbarao as the governor of the Reserve Bank of India (RBI). The change could not have come at a more vulnerable time – the economic growth story is in a shambles, the rupee is staggering, and there is constant squabbling over the prescriptions for recovery.

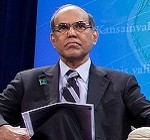

It is in this context that when Dr D Subbarao took the podium to deliver the Nani Palkhiwala memorial lecture on Thursday, his last public talk as the Governor of RBI, many would have expected the governor to keep the address the low key and non controversial, especially when his term at the head of RBI began in near tandem with the Great Meltdown of 2008 and has kept the central bank in near permanent crisis management mode till date.

But then, as they say, the aura of RBI, the criticality of the institution in whole monetary and fiscal machinery makes a new “you” bloom. And this seems to have been the case here too. Because Dr Subbarao while showing that he can stand up to the Finance Ministry and not shy away from some straight talking in the public arena, combined tough talk and confession with balance and political sagacity in his last lecture. Reading between the lines, therefore, becomes a necessity.

At the very start of the speech, the governor stated that India’s democratic system needed an “apolitical” central bank, manned by unelected professionals, accountable for their policies and results, to survive; especially when a typical government is working on an “electoral cycle” mode – a statement which places the RBI and the Finance Ministry next to each other as equals. The similarity lies in the envisioned constitutional division of power between the Lok Sabha and the Rajya Sabha. The next point of ‘respecting mandates’ was another shot in the same direction, while the reference to Mr Palkhiwala and safeguarding democratic institutions, was the crux of the salvo which told the government to stick to its turf if things were to function.

The next round of nuanced punches landed as the Governor defended the central bank against criticism of hawkish policy and stifling growth, saying this “would be inaccurate, unfair, and importantly, misleading….India’s economic activity slowed owing to a host of supply side constraints and governance issues, clearly beyond the purview of the Reserve Bank.” He also said that if RBI’s repo rate was the only factor preventing growth, then there should have been more positive and immediate response to its rate cuts and open market operations in the recent past.

Plainly put, this meant North Block had dropped the ball on keeping the sails of India’s economic story pointing in the right direction.

The RBI had raised interest rates 13 times between March 2010 and October 2011, primarily to contain inflation spiral. But then lowered rates by 125 bps between April 2012 and May 2013 as inflation seemed tamed and growth needed attention. In the governor’s own words, the central bank would keep money tight not because it did not care about growth but because it cares for growth in the longer run.

But nothing in the higher echelons of power is so simple. Thus, the governor drew attention to a particular period of 2009-2012, when the world economic crisis was ongoing and Mr Pranab Mukherjee, who is now the President, presided over the Finance Ministry. Subbarao stated that the lack of “fast fiscal consolidation” during this period cut the “degrees of freedom” for RBI to manoeuvre and forced it to keep raising interest rates to keep inflation down thereby widening the damage to growth.

He also added that the feeling of vulnerability today on the current account deficit and exchange rate front on signs of the Federal Reserve tapering off its ultra easy money policy was due to the squandering of the opportunity by the Finance Ministry then to make use the ample liquidity to correct the structural factors and thereby keeping the CAD unsustainably high. The fears of a repeat of the 1991 balance of payments crisis seem unrealistic according to most analysts given the changed nature of Indian and global economy.

Subbarao, thus, suggested that Chidambaram’s predecessor is the one who needs to take the rap – a view that Chidambaram himself articulated recently without naming Mr Mukherjee directly. Thus, the governor balanced the brickbats and the balm. The long experience of dealing with the “system” and political masters garnered in his four decades in the elite Indian Administrative Service shows through.

But the governor was candid and humble enough to accept mistakes. We can call it so because accepting a mistake is a rare thing in central bank circles and confessing twice on the same day is history. Subbarao agreed that in hindsight, India might have been better off if the RBI had started raising interest rates sooner when the economy began recovering. And more recently, it could have done a better job of explaining the intentions behind the various steps in the last three months to support India’s declining currency.

The Indian rupee has been pushed to a record low of 68.85 to a dollar and is the worst performing currency in Asia. The rupee has recovered some bit thanks to aggressive dollar selling by the RBI. But currency reserves fell to $277.72 billion as of August 23, enough to cover over 6 months of imports and down $19 billion since the end of last year, Reuters reported. The importance of reserve kitty is even more for India due to the current account deficit and fiscal deficit it has to deal with. So every dollar is literally squeezed out to build the reserve pile.

On the future of RBI, the governor stated that the central bank will have to learn to manage both economic and regulatory policies in a globalizing world. It will particularly have to pay attention to the spill-over impact of the policies of advanced economies on India’s macro-economy. This is indeed the need of the hour as the ratio of total external transactions to GDP more than doubled from 44 per cent in 1998-1999 to 112 per cent in 2008-2009, attesting of the depth of India’s financial integration with the global economy.

But for success in this mission, the central bank needed autonomy created by writing the mandate of the RBI into the statute books which would protect it from the political dynamics of changing governments. A stark reminder of the dangers of an immature democracy still trapped in a feudal mindset. This fact is borne out by the governor asking the RBI to also listen to the ‘silent voice of the poor’ and asked it to be zealous about rendering accountability as it is about guarding its autonomy.

This writer was once told that Dr Y V Reddy, the predecessor of Dr Subbarao wanted to leave him imprint on the office of Governor of RBI as a legacy, one can wonder what Dr Subbarao might want to do considering the fire fighting he has had to do since Lehman Brothers ran out of luck 5 years ago.

Aditya V. Phatak is a Senior Researcher for Gateway House. He previously was a journalist and has written extensively on Indian financial markets for international and Indian media houses.

This blog was exclusively written for Gateway House: Indian Council on Global Relations. You can read more exclusive content here.

For interview requests with the author, or for permission to republish, please contact outreach@gatewayhouse.

© Copyright 2013 Gateway House: Indian Council on Global Relations. All rights reserved. Any unauthorized copying or reproduction is strictly prohibited