This article is an extension of a policy brief written by Gateway House for the Think20 Taskforce on ‘International Financial Architecture for Stability and Development’ under Argentina’s G20 Presidency in 2018 on ‘A global framework for tracing Beneficial Ownership‘.

The 2008 global financial crisis, increasing instances of money laundering, terrorist financing and tax evasion revealed the lack of transparency in cross-border financial transactions. The Lehman Brothers’ crisis, in particular, highlighted the importance of identifying the ownership structures of legal entities engaged in such transactions to better understand the systemic risks arising out of these linkages. In response, the G20 countries[1] called for greater transparency in cross-border financial transactions.

At the G20 Cannes Summit of 2011[2], the G20-supported Financial Stability Board (FSB) was mandated by the G20 leaders with the task of delivering recommendations[3] on the creation and implementation of a unique global code, called the Legal Entity Identifier (LEI). In 2014, the LEI came into legal effect.

What exactly is the LEI? The LEI contains within it, two parts of an entity’s lineage: who is who and who owns whom. This, a 20-digit alphanumeric code, holds standardised reference information on legal entities that participate in global financial transactions, serving as a proof of identity. This is basic business card information, giving clarity on “who is who[4]” among market participants.

Its database, the Global LEI Index[5], is gradually being developed[6] to identify an entity’s direct[7] and ultimate[8] parents, answering the question of “who owns whom[9]”. The Global Legal Entity Identifier Foundation[10] (GLEIF) leads the implementation process. It designates local operating units (LOUs) around the world, which provide registration and renewal facilities.

An entity can register[11] with any LOU of its choice, provided it lies in the LOU’s jurisdiction. Typically, these LOUs are part of a country’s official financial system. In India, for instance, the LEI is issued by the Legal Entity Identifier India Ltd. (LEIL), a wholly-owned subsidiary of the Clearing Corporation of India, and is governed by the Reserve Bank of India. In the U.S., the sponsoring authority is the U.S. Commodity Futures Trading Commission[12] – but private financial services player, Bloomberg[13], is also authorised to issue LEIs. In China, it is the China Financial Standardisation Technical Committee[14].

The information disclosed by the registrant is stored by the LOU in its database. It is publicly available[15] and free of charge. It is reviewed, updated and validated by the LEI holder and the LOU through an annual renewal process. Banks, credit rating agencies and other institutions can access this database to gather accurate and credible information on their clients. LEIs, in addition, can help process letters of credit quicker and help identify sellers and suppliers on e-invoicing networks worldwide.

It can reduce business losses caused when transactions are rejected due to inadequate information or delays while on-boarding clients. A 2017 McKinsey study estimates that the use of LEIs in capital markets will reduce operational costs for the global investment banking industry by 3.5%[16], generating annual savings worth over $150 million.

LEI has plenty of takers. At the moment, capital markets participants who trade in over-the-counter (OTC) derivatives have been early adopters of the LEI; Canada, the EU, India, Mexico, Russia, Singapore, Switzerland and the U.S. were the first[17] to accept it. Gradually, all entities, engaged in a wide range of cross-border transactions, will have to obtain an LEI.

To enable this, the administrative capacity and infrastructure of issuing LOUs must be improved.

Each country has its own official LEI issuer, and a unique response to participate in the LEI. India’s issuer is the LEIL.[18] In 2017, the Reserve Bank of India (RBI) set phased deadlines[19] for legal entities to obtain LEIs, failing which they would not be eligible to participate in OTC derivative markets. Companies were slow to respond, and missed the deadline of 31 March 2018[20]. But now there is a rush to apply, and the deadline has been extended to 30 September 2018.

So far, 11,521[21] LEIs have been issued in India and as of 11 September 2018, 2,210 are pending acceptance. The slow pace of adoption – not just in India – is not surprising. LEI issuers and registrants have both reported that the process is complex and tiresome. Since the information is self-declared, the registrant is responsible for its accuracy.[22] The issuers have reported that the registrants are oblivious of the requirements, and the declared information is incomplete and of poor quality. They also do not notify the issuer on new information, leading to inconsistencies, delays and data gaps – and potential loss of business for not being on board, on time.

This is a particular challenge for LOUs, which have to manually validate it[23], using official regulatory documents and private legal records.

However, the LEI is the gold standard of identifier information. A comparative study by Gateway House with other identification numbers used in India revealed that LEI’s database is the only repository in the country that captures the relationship between the legal entity and its direct and ultimate parents. This gives India a strong rationale for extending the adoption of the LEI to any legal entity beyond those that trade in the OTC market.

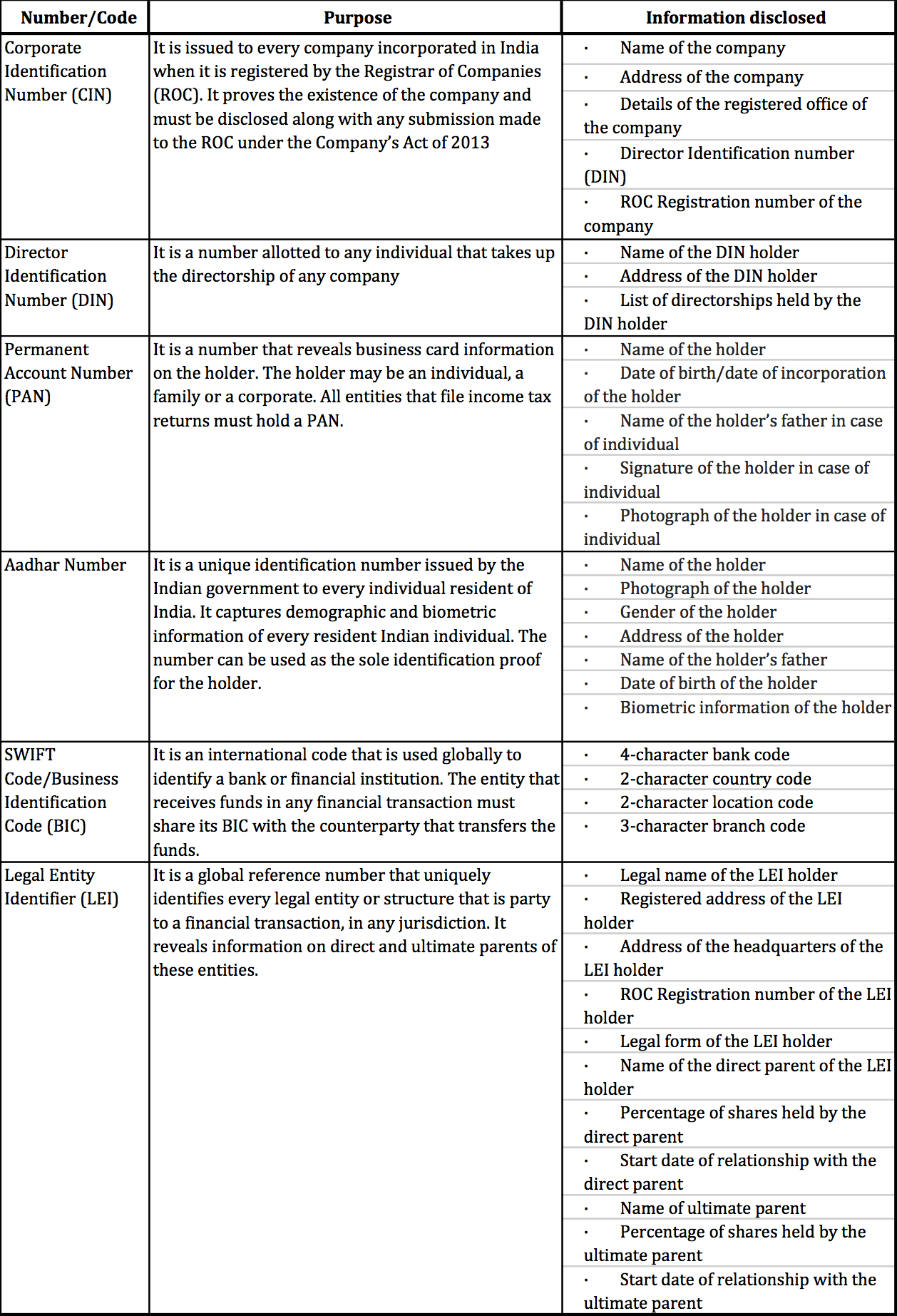

The table below shows how superior the LEI’s documentation is: it includes additional information like the shareholding structure, names and financial statements of the direct and ultimate parents. This database can be a one-stop destination for individuals, corporations, academics, media seeking complete reference information on an entity; and regulators and governments, who can get special access.

Table1: A comparison of identification numbers/codes in India

A salient feature of the LEI is that it can be integrated with other identification codes and processes. SWIFT’s full BIC-to-LEI mapping[24] initiative is a case in point. It is being explored by global software firms like R3[25], as the primary identifier that can integrate with solutions like distributed ledgers, connecting and cross-referencing all available information on an entity.

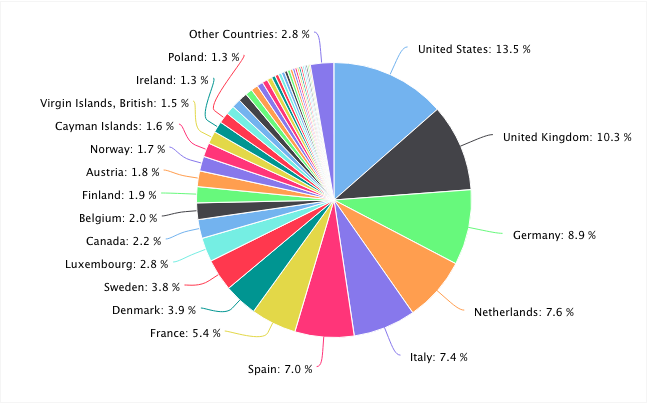

Chart 1: LEI adoption by country

As of September 2018, 1,267,387[27] LEIs have been issued in 223 countries and 83,652 direct and ultimate parents have been identified. The largest number of registrations[28] were reported in the U.S., U.K, Germany, Netherlands and Italy. Regulatory requirements in the Dodd-Frank Act[29] of the U.S and the EU’s Markets in Financial Instruments Directive (MiFID II)[30] and Regulation (MiFIR), have made it compulsory[31] for entities to adopt LEIs. Also, in the U.S. and the EU, many issuers have been designated to issue LEIs, encouraging a larger number of registrations.

LEI applications[32] in India, Estonia, Portugal, Mexico and Slovenia have gradually risen compared to previous quarters. The trend in India[33] is attributed to the RBI’s phased implementation deadlines. However, countries like India, South Korea and Mexico have only one LOU that is overwhelmed by a large number of applications.

The LEI implementation process today is functioning at an optimal pace, despite its complexities. Like everything good, global practitioners and industry experts expect the system to crystallise in three years after which it will be possible to trace an entire chain of ownership structures, using the LEI, increasing transparency in cross-border financial transactions.

To enhance the efficacy of the LEI, a global framework is required. In a policy brief[34] for the G20, Gateway House has proposed such a global framework for sharing, cross-referencing and tracing information on an entity’s direct and ultimate parents – known as beneficial ownership information – by travelling up-and-down a series of multi-country cross-border transactions. The LEI can be distinctive in this framework. Using information available on the LEI database, any financial transaction can be studied accurately from one end to another and linkages to fraudulent financial practices can be uncovered. It can help identify the total exposure of one company to another, unveiling possible systemic risks arising out of such linkages.

The hope is that such rigorous and robust verifications can prevent another global financial crisis.

Purvaja Modak is Researcher, Geoeconomic Studies, and Assistant Manager, Research Office, Gateway House: Indian Council on Global Relations.

This article is an extension of a policy brief written by K.N Vaidyanathan, Akshay Mathur and Purvaja Modak for the Think20 Taskforce on ‘International Financial Architecture for Stability and Development’ under Argentina’s G20 Presidency in 2018 on ‘A global framework for tracing Beneficial Ownership‘.

This article was exclusively written for Gateway House: Indian Council on Global Relations. You can read more exclusive features here.

For interview requests with the author, or for permission to republish, please contact outreach@gatewayhouse.in

© Copyright 2018 Gateway House: Indian Council on Global Relations. All rights reserved. Any unauthorized copying or reproduction is strictly prohibited.

References:

[1] Basel Committee on Banking Supervision, Guidelines for the Sound Management of Risks Related to Money Laundering and Financing of Terrorism, February 2016, <https://www.bis.org/bcbs/publ/d353.pdf >

[2] G20 Information Centre, Cannes Summit Final Declaration – Building Our Common Future: Renewed Collective Action for the Benefit of All, <http://www.g20.utoronto.ca/2011/2011-cannes-declaration-111104-en.html >

[3] Financial Stability Board, A Global Legal Entity Identifier for Financial Markets, <http://www.fsb.org/wp-content/uploads/r_120608.pdf >

[4] Global Legal Entity Identifier Foundation, Legal Entity Identifier (LEI) Level 1 Data, <https://www.gleif.org/en/lei-data/access-and-use-lei-data/level-1-data-who-is-who>

[5] Global Legal Entity Identifier Foundation, Global Legal Entity Identifier (LEI) Index, <https://www.gleif.org/en/lei-data/global-lei-index>

[6] Legal Entity Identifier Regulatory Oversight Committee, Progress Report – The Global LEI System and regulatory uses of the LEI, 30 April 2018, <https://www.leiroc.org/publications/gls/roc_20180502-1.pdf>

[7] Direct Parent” is defined as the lowest-level legal entity that prepares consolidated financial statements that consolidate the entity’.

[8] “Ultimate Parent” is defined as the highest-level legal entity preparing consolidated financial statements, as well as their “direct accounting consolidating parent”. Source: https://www.ccilindia-lei.co.in/Documents/FAQs_V1.1_05-06-2017.pdf

[9] Global Legal Entity Identifier Foundation, Legal Entity Identifier (LEI) Level 2 Data, <https://www.gleif.org/en/lei-data/access-and-use-lei-data/level-2-data-who-owns-whom#>

[10] Global Legal Entity Identifier Foundation, About GLEIF, <https://www.gleif.org/en/about/this-is-gleif>

[11] Global Legal Entity Identifier, How to choose a Local Operating Unit, 10th July 2017, <https://www.globallei.com/blog/choosing-an-lou>

[12] U.S. Commodity Futures Trading Commission, Government of the United States of America <https://www.cftc.gov/>https://www.cftc.gov/

[13] Bloomberg L.P., <https://www.bloomberg.com/company/

[14] China Legal Entity Identifier System, <http://www.leichina.org/cei/index.html>

[15] Global Legal Entity Identifier Foundation, About Legal Entity Identifier (LEI), <https://www.gleif.org/en/about-lei/introducing-the-legal-entity-identifier-lei>

[16] McKinsey & Company, The Legal Entity Identifier: The Value of the Unique Counterparty ID, 2017, <https://www.mckinsey.com/~/media/McKinsey/Industries/Financial%20Services/Our%20Insights/The%20legal%20entity%20identifier%20The%20value%20of%20the%20unique%20counterparty%20ID/Legal-Entity-Identifier-McKinsey-GLEIF-2017.ashx>

[17] Ibid

[18] Reserve Bank of India, Press Release – Issuer under the Payment and Settlement Systems Act, 2007, <https://www.rbi.org.in/Scripts/BS_PressReleaseDisplay.aspx?prid=38108>

[19] Reserve Bank of India, RBI Notification No. RBI/2016-17/314, 1st June 2017, <https://rbidocs.rbi.org.in/rdocs/notification/PDFs/NOTI3143399AEE12E684FCF9FEEA7E03E0E9064.PDF>

[20] Ibid

[21] Legal Entity Identifier India Limited, Data Metrics, <https://www.ccilindia-lei.co.in/AD_LEI_CHART.aspx> (Accessed on 14th September 2018).

[22] Legal Entity Identifier Regulatory Oversight Committee, Collecting data on direct and ultimate parents of legal entities in the Global LEI System – Phase 1, <https://www.leiroc.org/publications/gls/lou_20161003-1.pdf>

[23] Ibid

[24] Global Legal Entity Identifier Foundation, Download BIC-to-LEI Relationship Files, <https://www.gleif.org/en/lei-data/lei-mapping/download-bic-to-lei-relationship-files>

[25] Ibid

[26] Global Legal Entity Identifier Foundation, LEI Statistics, <https://www.gleif.or/en/lei-data/global-lei-index/lei-statistics>

[27] Ibid

[28] Global Legal Entity Identifier Foundation, Global LEI System Business Report, Q2 2018, <https://www.gleif.org/_documents/blog/20180808-gleif-published-the-quarterly-global-lei-system-business-report-covering-the-second-quarter-of-2018/2018-08-08_quarterly_business_report.pdf >

[29] U.S. Commodity Futures Trading Commission, Government of the United States of America, Amended Order Designating The Provider Of Legal Entity Identifiers To Be Used In Recordkeeping And Swap Data Reporting Pursuant To The Commission’s Regulations, <https://www.cftc.gov/sites/default/files/idc/groups/public/@newsroom/documents/file/leiamendedorder.pdf>

[30] Financial Conduct Authority, MiFID II – Legal Entity Identifier (LEI) update, <https://www.fca.org.uk/markets/mifid-ii/legal-entity-identifier-lei-update>

[31] Emissions-EUETS, Legal Entity Identifier (LEI) use under the EU financial regulation, <https://www.emissions-euets.com/internal-electricity-market-glossary/839-lei>

[32] Global Legal Entity Identifier Foundation, Global LEI System Business Report: Q2 2018, 8 August 2018, <https://www.gleif.org/_documents/blog/20180808-gleif-published-the-quarterly-global-lei-system-business-report-covering-the-second-quarter-of-2018/2018-08-08_quarterly_business_report.pdf>

[33] Global Legal Entity Identifier Foundation, GLEIF Published the Quarterly Global LEI System Business Report Covering the Second Quarter of 2018, 8 August 2018, <https://www.gleif.org/en/newsroom/blog/gleif-published-the-quarterly-global-lei-system-business-report-covering-the-second-quarter-of-2018>

[34] Vaidyanathan, K. N., Akshay Mathur, Purvaja Modak, T20 Argentina 2018, An International Financial Architecture for Stability and Development: A global framework for tracing Beneficial Ownership, <https://t20argentina.org/wp-content/uploads/2018/06/TF9.9.8-Final.pdf>